Curious how well insiders are doing with their buys? Scroll the significant buys of the last year.

Name: Winfrey Christopher L

Position: COO

Transaction Date: 2022-02-01 Shares Bought: 2,750 Average Price Paid: $591.96 Cost: $1,627,886

Company: Charter Communications Inc. (CHTR)

Charter Communications, Inc. operates as broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based video services, including video on demand, high-definition television, digital video recorder, pay-per-view services. It provides Internet services, such as security suite that protects computers from viruses and spyware, and threats from malicious actors; in-home WiFi, which provides customers with high-performance wireless routers to enhance their in-home wireless Internet experience; out-of-home WiFi; and Spectrum WiFi services, as well as video services. The company also offers voice communications services using voice over Internet protocol technology; and broadband communications solutions, such as Internet access, data networking, fiber connectivity, video entertainment, and business telephone services to cellular towers and office buildings for business and carrier organizations. In addition, it provides mobile services; offers video programming, static IP and business WiFi, email and security, and multi-line telephone services, as well as Web-based service management; sells local advertising across various platforms for networks, such as TBS, CNN, and ESPN; sells advertising inventory to local sports and news channels; and offers Audience App for optimizes linear inventory. Further, the company offers communications products and managed service solutions; data connectivity services to mobile and wireline carriers on a wholesale basis; and owns and operates regional sports and news networks. It serves approximately 32 million customers in 41 states. The company was founded in 1993 and is headquartered in Stamford, Connecticut.

Christopher Winfrey was named Chief Operating Officer of Charter Communications in October of 2021. He oversees all Cable operations across Charter’s 41-state footprint, including marketing, sales, field operations and customer operations, as well as Spectrum Enterprise. Mr. Winfrey joined Charter as Chief Financial Officer in 2010 responsible for Charter’s accounting, financial planning and analysis, procurement, real estate, tax and treasury functions, as well as mergers and acquisitions, capital structure activities and investor relations. In addition, Charter added oversight of its fiber-based business services (Spectrum Enterprise) to his CFO responsibilities in 2019, and operational leadership of the residential and SMB Sales and Marketing organization, and Spectrum Community Solutions in February of 2021.

Opinion: No new leader, not even Chris Winfrey or Jesus Christ himself, is going to change the dynamics of this industry. Cable is dead other than the fact that it has big pipes. The fiber connects that Comcast and Brian Roberts invested heavily in kept Comcast alive and earned the ire of legions of customers as the only thing most of us need Comcast or for the matter Charter in an online wramp to the Internet. I’d avoid this one.

Name: Walmsley Emma N

Position: Director

Transaction Date: 2022-01-28 Shares Bought: 3,300 Average Price Paid: $303.26 Cost: $1,000,761

Company: Microsoft Corp. (MSFT)

Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. Its Productivity and Business Processes segment offers Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, and Skype for Business, as well as related Client Access Licenses (CAL); Skype, Outlook.com, OneDrive, and LinkedIn; and Dynamics 365, a set of cloud-based and on-premises business solutions for organizations and enterprise divisions. Its Intelligent Cloud segment licenses SQL, Windows Servers, Visual Studio, System Center, and related CALs; GitHub that provides a collaboration platform and code hosting service for developers; and Azure, a cloud platform. It also offers support services and Microsoft consulting services to assist customers in developing, deploying, and managing Microsoft server and desktop solutions; and training and certification on Microsoft products. Its More Personal Computing segment provides Windows original equipment manufacturer (OEM) licensing and other non-volume licensing of the Windows operating system; Windows Commercial, such as volume licensing of the Windows operating system, Windows cloud services, and other Windows commercial offerings; patent licensing; Windows Internet of Things; and MSN advertising. It also offers Surface, PC accessories, PCs, tablets, gaming and entertainment consoles, and other devices; Gaming, including Xbox hardware, and Xbox content and services; video games and third-party video game royalties; and Search, including Bing and Microsoft advertising. It sells its products through OEMs, distributors, and resellers; and directly through digital marketplaces, online stores, and retail stores. It has collaborations with Dynatrace, Inc., Morgan Stanley, Micro Focus, WPP plc, ACI Worldwide, Inc., and iCIMS, Inc., as well as strategic relationships with Avaya Holdings Corp. and wejo Limited. Microsoft Corporation was founded in 1975 and is based in Redmond, Washington.

Prior to this, Walmsley was the CEO of GSK Consumer Healthcare, a Joint Venture between GSK and Novartis, from its creation in 2015, and has been a member of GSK’s Corporate Executive Team since 2011. She joined GSK in 2010, with responsibility for Consumer Healthcare, Europe. Prior to joining GSK, Walmsley worked with L’Oreal for 17 years where she held a variety of marketing and general management roles in Paris, London and New York. From 2007 she was based in Shanghai as General Manager, Consumer Products for L’Oreal China. Walmsley co-chairs the Consumer, Retail and Life Sciences Council, a business advisory group for the UK Government. She was a Non-Executive Director of Diageo plc in 2016..

Opinion: Apparently just buy and leave it alone.

Name: Bradford Gregory R

Position: Chief Executive CACI Limited

Transaction Date: 2022-01-31 Shares Bought: 1,111 Average Price Paid: $245.92 Cost: $273,217

Company: Caci International Inc. (CACI)

CACI International Inc, together with its subsidiaries, provides expertise and technology to enterprise and mission customers in support of national security missions and government modernization/transformation in the intelligence, defense, and federal civilian sectors. It operates in two segments, Domestic Operations and International Operations. The Domestic Operations segment provides information solutions and services to the U.S. federal government agencies and commercial enterprises in the areas, such as digital solutions, C4ISR, cyber and space, engineering services, enterprise IT, and mission support. The International Operations segment offers a range of IT services, proprietary data, and software products to commercial and government customers in the United Kingdom, continental Europe, and internationally. The company designs, develops, integrates, deploys, and sustains enterprise-wide IT systems in a variety of models; delivers cloud-powered solutions, performance-based service management, software-as-a service secure mobility, defensive cyber and network security, end-user services, and infrastructure services. It also delivers technology that includes developing and implementing digital solutions, and enterprise IT systems for enterprise customers; and technology for customers that includes developing and deploying multi-domain offerings for signals intelligence, resilient communications, free space optical communications, electronic warfare, and cyber operations. In addition, the company provides capabilities in areas, such as command and control, communications, intelligence collection and analysis, signals intelligence (SIGINT), electronic warfare, and cyber operations. Further, it offers investigation and litigation support services; and SIGINT and cyber products and solutions to the Intelligence Community and Department of Defense. The company was founded in 1962 and is headquartered in Reston, Virginia.

As head of CACI’s United Kingdom operation, Mr. Bradford manages a diverse business providing a mix of IT services and proprietary data and software products to commercial and government clients, primarily in the UK but also in Europe and elsewhere in the world. Under Mr. Bradford’s leadership, CACI operates in three addressable markets internationally: Marketing Solutions, Social Services, and Network Services. In each of these markets, CACI is recognized as a provider of high-value solutions focused on helping clients meet their important missions. Mr. Bradford transferred from CACI’s corporate headquarters in Washington, D.C. to its London office in 1984. Taking the helm of what was then a small, fledgling operation, Mr. Bradford and his management team have created a business that now ranks as one of the top IT services and software companies in the UK.

Opinion:Looks like a purchase on a timely pullback but not enough to pique my interest yet.

Name: Gibbons Dale

Position: CFO

Transaction Date: 2022-02-01 Shares Bought: 5,000 Average Price Paid: $99.68 Cost: $498,400

Company: Western Alliance Bancorporation. (WAL)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates in two segments, Commercial and Consumer Related. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; and treasury management and residential mortgage products and services. It also offers commercial and industrial loan products, such as working capital lines of credit, inventory and accounts receivable lines, mortgage warehouse lines, equipment loans and leases, and other commercial loans; commercial real estate loans, which are secured by multi-family residential properties, professional offices, industrial facilities, retail centers, hotels, and other commercial properties; construction and land development loans for single family and multi-family residential projects, industrial/warehouse properties, office buildings, retail centers, medical office facilities, and residential lot developments; and consumer loans. In addition, the company provides other financial services, such as internet banking, wire transfers, electronic bill payment and presentment, lock box services, courier, and cash management services. Further, it holds certain investment securities, municipal and non-profit loans, and leases; invests primarily in low income housing tax credits and small business investment corporations; and holds certain real estate loans and related securities. The company operates 38 branch locations, as well as loan production offices. Western Alliance Bancorporation was founded in 1994 and is headquartered in Phoenix, Arizona.

Dale M. Gibbons is Vice Chairman of Western Alliance Bancorporation and has been Chief Financial Officer since May 2003. Mr. Gibbons has more than 30 years of experience in commercial banking, including serving as Chief Financial Officer and Secretary of the Board of Zions Bancorporation from August 1996 to June 2001. From 1979 to 1996, he worked for First Interstate Bancorp in a variety of retail banking and financial management positions. Mr. Gibbons is a summa cum laude graduate of Arizona State University and a CPA.

Opinion: The conventional wisdom is that rising interest rates due to a robust economy are the perfect environment for bank stocks. The operative word here is “robust economy”. Interest rates can rise for reasons divorced from improving financial conditions. For example, the Fed may find inflation expectations need to be tamped down by rising rates, or that supply chain disruptions and labor shortages are causing the price of goods to rise and in their blunt toolbox, they might feel they need to raise rates. We are watching this closely as several insides are buying regional banks. The last time this happened was last summer when the group was very depressed. That’s not ht case right now.

Name: Kujawa Rebecca J

Position: CFO

Transaction Date: 2022-01-28 Shares Bought: 7,000 Average Price Paid: $71.83 Cost: $502,810

Name: Robo James L

Position: CEO Chairman

Transaction Date: 2022-01-31 Shares Bought: 64,691Average Price Paid: $77.26 Cost: $4,998,285

Company: Nextera Energy Inc. (NEE)

NextEra Energy, Inc., through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, and fossil fuel, such as coal and natural gas facilities. It also develops, constructs, and operates long-term contracted assets with a focus on renewable generation facilities, electric transmission facilities, and battery storage projects; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets. As of December 31, 2020, the company operated approximately 28,400 megawatts of net generating capacity. It serves approximately 11 million people through approximately 5.6 million customer accounts in the east and lower west coasts of Florida with approximately 76,200 circuit miles of transmission and distribution lines and 673 substations. The company was formerly known as FPL Group, Inc. and changed its name to NextEra Energy, Inc. 1925 Florida Power & Light Company was created on Dec. 28, 1925. In the beginning, FPL owned power plants, water facilities, gas plants, ice companies, laundry services and even an ice cream business. In its first year, the company served approximately 76,000 customers in 58 communities, and had a generating capacity of 70 MW. One year after the company was created, it was serving approximately 115,000 customers in 112 communities. Florida Power & Light Company, which serves more than five million customer accounts in Florida and is the largest rate-regulated electric utility in the United States as measured by retail electricity produced and sold; and Gulf Power Company, which serves more than 460,000 customers in eight counties throughout Northwest Florida. NextEra Energy also owns a competitive energy business, NextEra Energy Resources, LLC, which, together with its affiliated entities, is the world’s largest generator of renewable energy from the wind and sun and a world leader in battery storage. Through its subsidiaries, NextEra Energy generates clean, emissions-free electricity from eight commercial nuclear power units in Florida, New Hampshire, Iowa and Wisconsin. A Fortune 200 company and included in the S&P 100 index, NextEra Energy has been recognized often by third parties for its efforts in sustainability, corporate responsibility, ethics and compliance, and diversity. NextEra Energy is ranked No. 1 in the electric and gas utilities industry on Fortune’s 2019 list of “World’s Most Admired Companies” and ranked among the top 25 on Fortune’s 2018 list of companies that “Change the World.”

Ms. Kujawa has served as chief financial officer and a director of NEP LP since March 2019. She also serves as executive vice president, finance and chief financial officer for NEE. Previously, she served as vice president, business management of NEER since 2012. Ms. Kujawa joined NEE in 2007 and has held various business and finance roles, including the director of investor relations for NEE. Prior to joining NEE, Ms. Kujawa served as senior vice president of equity research at Stanford Group Company, and she began her career as an equity derivatives analyst at Goldman Sachs. Ms. Kujawa holds the Chartered Financial Analyst (CFA) designation and previously was a member of the New York Stock Exchange and National Association of Securities Dealers’ joint committee on the research analyst qualification exams.

Mr. Robo has been chairman of the board since December 2013, and president and chief executive officer, and a director, of NextEra Energy since July 2012. He is also chairman of NextEra Energy’s subsidiary, FPL (which has no publicly-traded stock). Prior to his succession to the role of chief executive officer, he served as president and chief operating officer of NextEra Energy since 2006. Mr. Robo joined NextEra Energy as vice president of corporate development and strategy in March 2002 and became president of NextEra Energy Resources later in 2002. Mr. Robo is chairman of the board and chief executive officer of NextEra Energy Partners, LP (“NEP”), a publicly-traded limited partnership formed by the Company (and in which the Company owns an underlying approximate 62% economic interest as of March 23, 2020). He is a director of J.B. Hunt Transport Services, Inc. (since 2002), and h#as served as J.B Hunt’s lead independent director since 2012.

Opinion: Buy, Buy, Buy. You can’t pick the bottom but you can start buying. This is an opportunity. We love regulated electric utilities. The world is going to go through an unparalleled increase in electricity usage due to EV’s, the transition to carbonless energy, the internet of things, and all the thousands of things we take for granted that will be attached to the Internet and all need electricity as the underlying means of transport.

The bear case is that rising rates will hurt income-producing stocks. The inverse relationship between bond yield and bond prices is certainly true when the dividend income is fixed. But utilities are guaranteed a rate of return, more properly expressed by ROIC, return on invested capital. The more they spend on improving the grid and the sources of reliable power, conversely the more they can charge. Utilities raise rates by investing more.

On January 31st, Daimler Truck North America (DDAIF), NextEra Energy Resources (NEE), LLC, and BlackRock Renewable Power (BLK), announced that they have signed a Memorandum of Understanding to lay the foundation for a proposed joint venture to design, develop, install and operate a nationwide, high-performance charging network for medium- and heavy-duty battery-electric and hydrogen fuel cell vehicles in the U.S. With the goal of accelerating the rollout of carbon-neutral freight transportation, the start of operations for the future JV is planned for 2022. Initial funding is expected to be comprised of approximately $650M divided equally among the three parties. Lack of a publicly available, nationwide electric charging infrastructure for commercial vehicles, especially those used for long-haul freight operations, remains one of the biggest barriers for the widespread deployment of electric trucks. With the formation of this JV, the three parties will be pooling their resources to address this challenge. The parties plan to build a network of charging sites on critical freight routes along the east and west coasts and in Texas by 2026, leveraging existing infrastructure and amenities while adding complementary greenfield sites to fulfill anticipated customer demand. The first phase is set to begin construction in 2023. The initial focus will be on battery electric medium- and heavy-duty vehicles followed by hydrogen fueling stations for fuel cell trucks; the sites will also be available for light-duty vehicles to serve the greater goal of electrifying mobility.

Name: Moskovitz Dustin A

Position: CEO Chairman 10% Owner

Transaction Date: 2022-01-02 Shares Bought: 1,250,000 Average Price Paid: $48.15 Cost: $60,187,048

Company: Asana Inc. (ASAN)

Asana is a web and mobile application designed to help teams organize, track, and manage their work. Forrester, Inc. reports that “Asana simplifies team-based work management. Asana helps teams orchestrate their work, from small projects to strategic initiatives. Headquartered in San Francisco, CA, Asana has more than 100,000 paying customers and millions of free organizations across 190 countries. Global customers such as Amazon, Japan Airlines, Sky, and Under Armour rely on Asana to manage everything from company objectives to digital transformation to product launches and marketing campaigns. Asana, Inc. offers a work management platform. The Company’s platform enables teams to orchestrate work, from daily tasks to cross-functional strategic initiatives. With its solution, Asana enables individuals to manage and prioritize across each of the projects. Its solution enables individuals to collaborate with teammates and have visibility into each team member’s responsibilities and progress. The Asana solution aids the team leads to manage work across a portfolio of projects or processes. The Company enables executives to communicate company-wide goals, monitor status, and oversee work across projects to gain real-time insights into which initiatives are on track or at risk. Asana is powered by its multidimensional data model called the work graph. The work graph captures and associates work units, the people responsible for executing those units of work, the processes in which work gets done, information about that work, and the relationships across and within the data.

Dustin Moskovitz is the co-founder and CEO of Asana. As Asana’s CEO, Dustin is dedicated to creating a product that helps the world’s teams collaborate effortlessly, in addition to leading the company’s award-winning culture. Prior to founding Asana, Dustin co-founded Facebook and served as the company’s first Chief Technology Officer and VP of Engineering.

Opinion: More insanity. One day I hope to understand the logic behind Moskovitz’s relentless buying of Asana. Interesting to note that the general counsel for the company sold nearly a million dollars worth of stock last week, unloading 17480 shares awarded at $4.02 per share. This was reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan, of course. Excuse me if I’m cynical but I am.

Name: Kip Jeffrey W

Position: Director

Transaction Date: 2022-01-31 Shares Bought: 10,000 Average Price Paid: $29.25 Cost: $292,471

Company: Berkshire Hills Bancorp Inc. (BHLB)

Berkshire Hills Bancorp, Inc. operates as a bank holding company for Berkshire Bank that provides various banking products and services. It offers various deposit accounts, including demand deposit, NOW, regular savings, money market savings, time certificates of deposit, and retirement deposit accounts; and loans, such as commercial real estate, commercial and industrial, consumer, and residential mortgage loans. The company also provides wealth management services comprising investment management, trust administration, and financial planning; and investment products, financial planning, and brokerage services. In addition, it offers electronic banking, commercial cash management, online banking, and mobile banking services; and debit cards and other electronic fee producing payment services to transaction account customers. Further, the company, through its subsidiary, Berkshire Insurance Group, Inc., provides personal and commercial property, and casualty insurance; employee benefits insurance; and life, health, and financial services insurance products. It serves personal, commercial, not- profit, and municipal deposit customers. As of December 31, 2020, the company operated 130 full-service branches in Massachusetts, New York, Connecticut, Vermont, Central New Jersey, and Eastern Pennsylvania. Berkshire Hills Bancorp, Inc. was founded in 1846 and is headquartered in Boston, Massachusetts.

Jeffrey W. Kip to Join Board as Independent Director & Financial Expert, Aug. 25, 2021 /PRNewswire/ — Berkshire Hills Bancorp, Inc. (NYSE: BHLB), announced today that Board Chairperson J. Williar (“Bill”) Dunlaevy will retire from the joint Board of Directors of the company and its wholly-owned subsidiary Berkshire Bank effective September 22, 2021. As part of a pre-established succession plan, the Board has unanimously voted to appoint David M. Brunelle to succeed Mr. Dunlaevy as Chairperson, also effective on that date. Mr. Brunelle currently serves as Vice Chairperson of the Board and previously served as Chairperson of the Audit Committee after joining the Board in 2017.

Opinion:

Name: Rutherford John R

Position: Director

Transaction Date: 2022-02-02 Shares Bought: 10,000 Average Price Paid: $23.72 Cost: $237,205

Company: Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. The company operates through four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Proiducts Services. The NGL Pipelines & Services segment offers natural gas processing and related NGL marketing services. It operates 21 natural gas processing facilities in Colorado, Louisiana, Mississippi, New Mexico, Texas, and Wyoming; NGL pipelines; NGL fractionation facilities; NGL and related product storage facilities; and NGL marine terminals. The Crude Oil Pipelines & Services segment operates crude oil pipelines; and crude oil storage and marine terminals, including a fleet of 310 tractor-trailer tank trucks used to transport liquefied petroleum gas. It also engages in crude oil marketing activities. The Natural Gas Pipelines & Services segment operates natural gas pipeline systems to gather, treat, and transport natural gas. It leases underground salt dome natural gas storage facilities in Napoleonville, Louisiana; owns an underground salt dome storage cavern in Wharton County, Texas; and markets natural gas. The Petrochemical & Refined Products Services segment operates propylene fractionation and related marketing activities; butane isomerization complex and related deisobutanizer units; and octane enhancement and high purity isobutylene production facilities. It also operates refined products pipelines and terminals; and ethylene export terminals, and provides refined products marketing and marine transportation services. The company was founded in 1968 and is headquartered in Houston, Texas.

Mr. Rutherford was elected as a director of Enterprise GP in January 2019 and is a member of its Audit and Conflicts Committee. He is a Senior Managing Director of NRI Energy Partners LLC. This firm evaluates and invests in private and public energy companies and provides financial and strategic consulting services to energy companies and investment firms. His career includes over 20 years of investment banking experience as mergers and acquisitions and strategic advisor to public and private energy companies, investment firms, management teams, and boards of directors. Before joining Plains, Mr. Rutherford served as Managing Director of the North American Energy Practice of Lazard Freres & Company from 2007 until 2010.

Opinion: This makes sense. It doesn’t seem like natural gas pipelines are the dinosaurs we thought they were before the Russian Ukrainian showdown.

Name: Barker James Andrew

Position: Director

Transaction Date: 2022-02-01 Shares Bought: 12,900 Average Price Paid: $19.32 Cost: $249,187

Company: Banc Of California Inc. (BANC)

Banc of California, Inc. operates as the bank holding company for Banc of California, National Association that provides banking products and services in the United States. The company offers deposit products, including checking, savings, money market, retirement, and interest-bearing and noninterest-bearing demand accounts, as well as certificate of deposits. It also provides various commercial and consumer loan products, such as commercial and industrial loans; commercial real estate and multifamily loans; construction loans; single family residential mortgage loans; warehouse and indirect/direct leveraged lending; home equity lines of credit; small business administration loans; and other consumer loans. In addition, the company offers automated bill payment, cash and treasury management, foreign exchange, card payment, remote and mobile deposit capture, automated clearing house origination, wire transfer, direct deposit, and internet banking services; and master demand accounts, interest rate swaps, and safe deposit boxes. Further, it invests in collateralized loan obligations, agency securities, municipal bonds, agency residential mortgage-backed securities, and corporate debt securities. As of December 31, 2020, the company operated 29 full-service branches in Southern California. The company was formerly known as First PacTrust Bancorp, Inc. and changed its name to Banc of California, Inc. in July 2013. Banc of California, Inc. was founded in 1941 and is headquartered in Santa Ana, California..

Mr. Barker has over 30 years of experience in corporate strategy, private equity, and management of large corporate enterprises. Since 1998, Mr. Barker has served as Co-President and 25% owner of Velocity Vehicle Group, a privately owned group of companies that serve the truck, bus and capital equipment finance markets throughout the Southwest with revenues and assets in excess of $1 billion. Mr. Barker is also a board member and 50% owner of Velocity SBA, one of 14 non-bank small business lending companies in the United States licensed to originate loans under the Small Business Administration’s 7(a) program. From 1994 through 1997, Mr. Barker worked in Palo Alto, California for HAL Investments Inc., a private equity investment firm with holdings in real estate, maritime and industrial interests. From 1991 to 1994, Mr. Barker worked in the corporate strategy department of Sea Containers, Inc. in London, England setting business strategies for the multi-national transportation and hotel conglomerate.

Opinion: Another bank, pretty much the same observation. We are watching this sector to see if anything like the opportunity in the KRE shapes up from last year.

Name: Matlin David J

Position: Director

Transaction Date: 2022-02-01 Shares Bought: 101,352 Average Price Paid: $2.96 Cost: $300,002

Company: Clene Inc (CLNN)

Clene Inc., a clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel clean surfaced nanotechnology (CSN) therapeutics. The company has a nanotechnology drug suspension; and engages in the development and commercialization of dietary supplements. Its lead drug is CNM-Au8, which is being studied in various clinical trials, including a Phase 2 study for the treatment of stable multiple sclerosis; a Phase 2 biomarker study in Parkinson’s; and Phase 2 and Phase 3 trials to investigate the potential for disease modification for neurodegenerative diseases. The company’s products also include CNM-AgZn17, a topical gel polymer suspension of silver and zinc ions that is being developed for the treatment of infectious diseases and to accelerate wound healing; CNM-ZnAg, a broad-spectrum antiviral and antibacterial agent to treat disease-causing infections, such as COVID-19 and to provide immune support for symptom resolution; and CNM-PtAu7, a gold-platinum CSN therapeutic for oncology applications. Clene Inc. is headquartered in Salt Lake City, Utah.

Mr. Matlin was the Chief Executive Office of MatlinPatterson Global Advisers LLC, a global private equity firm, which he co-founded in 2002. David was a former Managing Director at Credit Suisse First Boston and also a founding partner of Merrion Group, LP. He currently serves on the public boards of MedTech Acquisition Partners (NASDAQ: MTAC) and U.S. Well Service (NASDAQ: USWS), as well as privately held Dermasensor, Inc., Pristine Surgical, LLC, Traffk, LLC, and Empyrean Neuroscience, Inc. David holds a JD from the Law School of the University of California at Los Angeles and a BS from the Wharton School of the University of Pennsylvania..

Opinion: What does a lawyer and a Wharton graduate know about a biotech firm? I’ll try to get by next week and find out.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

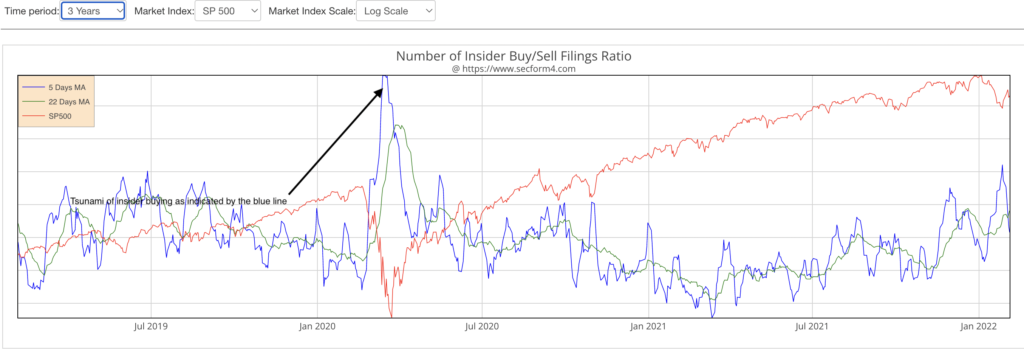

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health. It’s just one piece of the investor’s due diligence. The Insiders Fund blog informs you of the purchases that count. As a rule, we only look at material amounts of money as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong about, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts comment, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019