August ended on a low note as all three leading market indexes lost ground, with the Dow Jones Industrial Average (DJIA) falling 2.5%, the Nasdaq down 2.2%, and the S&P 500 off 1.7%. Insiders made some notable gains last week on their purchases, but since they are subject to the short-swing rule, it doesn’t really matter much to them since any short-term profits would have to be disgorged. For the most part, these insiders were bottom feeders on depressed company stock.

You can be an insider, too– by clicking here

Name: James Hollingshead

Position: President and CEO

Transaction Date: 2023-08-28 Shares Bought: 5,550 Average Price Paid: $181.41 Cost: $1,006,826

Company: Insulet Corp (PODD)

Insulet Corporation is an innovative medical device firm that uses its Omnipod delivery system to improve patients’ lives with diabetes and other diseases. Insulet Corporation principally develops, manufactures, and sells its unique Omnipod® System, a continuous insulin delivery system for persons with insulin-dependent diabetes that they have been marketing since 2005. Omnipod Insulin Management System, Omnipod DASH® Insulin Management System, and Omnipod® 5 Automated Insulin Delivery System are all part of the Omnipod System. Diabetes is a chronic, life-threatening condition for which no cure exists. The company estimates that insulin pump therapy is used by around 40% of the type 1 diabetes population in the United States and even less of the international type 1 diabetes community.

Dr. Hollingshead has been the President and Chief Executive Officer since June 1, 2022, and a member of the Board of Directors since July 2019. From July 2020 to May 2022, he was President of ResMed Inc.’s Sleep and Respiratory Care “SRC” business, a publicly traded global medical technology firm focused on treating sleep-related respiratory diseases. Dr. Hollingshead previously spent over two decades in strategy consulting across various industries, including biotech, high-tech, and telecommunications. Before that, he was a senior partner in Deloitte Consulting’s Strategy and Life Sciences practices and a Managing Partner of Monitor Group, a U.S. strategy consulting business. Dr. Hollingshead earned a Bachelor of Arts in History and International Relations with the Highest Distinction from Stanford University and a Master’s Degree and Ph.D. in Political Science from the University of California, Berkeley.

Opinion: This is the CEO’s first open market purchase of PODD stock since taking the helm a little over a year ago. Insulet has been on a Wegovy® and Mounjaro™ hypo price collapse due to the unsubstantiated belief that this new class of GLP-1 drugs can make a significant dent in the epidemic of Type 2 diabetes. According to what I’ve been able to research, Wegovy and Ozempic cannot stop diabetes. They are both injectable medications that help control blood sugar levels in people with type 2 diabetes. They work by stimulating the pancreas to produce more insulin and by helping the body use insulin more effectively. However, they are not a cure for diabetes and do not stop the progression of the disease.

Morgan Stanley lowered the firm’s price target on Insulet to $208 from $343 and kept an Equal Weight rating on the shares after updating its model following Q2 results. Though the firm recognizes “it’s still early in the debate,” it has lowered out-year estimates in light of recent GLP-1 data releases that limit visibility into the business’s long-term growth trajectory.

induced

Name: Daniel Patrick Gibson

Position: 10% Owner

Transaction Date: 2023-08-30 Shares Bought: 126,427 Average Price Paid: $63.32 Cost: $8,005,358

Company: Impinj Inc (PI)

The Impinj platform is a platform for developing IoT applications that connect physical objects to the cloud. The company platform delivers data that enables RAIN RFID to analyze, optimize, and virtualize everything. RAIN, a pioneered radio-frequency identification or RFID technology, is used in the firm platform. They advocated for the RAIN radio standard, encouraged nations to share frequency spectrum, and co-founded the RAIN Alliance, which now has over 150 members. They believe that RAIN’s capabilities, particularly endpoint ICs with serialized identifiers for individual items, battery-free operation, 30-foot range, not-in-line-of-sight readability, up to 1,000 reads per second, low cost, essentially unlimited life, and available cryptographic authentication, position RAIN as the leading IoT item-to-cloud connectivity technology.

Daniel Gibson has been a board of directors member since June 2018. Mr. Gibson is a founding partner of Sylebra Capital Management and has been a portfolio manager since June 2011 and chief investment officer since January 2018. Sylebra Capital Management is a Hong Kong-based investment management with a global concentration on the technology, media, and telecommunications industries. Before that, he worked as a partner and analyst at Coatue Capital from 2008 until 2011. From 2006 until 2008, he worked as an associate at Calera Capital, a Boston-based private equity firm. He began his career in the media group at UBS Investment Bank in New York. Mr. Gibson earned a B.A. in economics from Amherst College.

Opinion: A hedge fund is dramatically adding to its position after PII missed last quarter’s earnings and gave a dire forecast. Is this the bottom? Onlly time will tell.

Name: Mary E Meixelsperger

Position: Chief Financial Officer

Transaction Date: 2023-08-28 Shares Bought: 6,000 Average Price Paid: $33.55 Cost: $201,300

Company: Valvoline Inc (VVV)

Valvoline Inc. is a leader in preventative maintenance, providing easy and trustworthy automobile services in its retail outlets in the United States and Canada. Valvoline’s history dates back to 1866 and has amassed significant notoriety through numerous channels. Valvoline has continually adapted to changing technology and client needs and is well-positioned to handle evolving vehicle maintenance needs with Valvoline’s famous products. Valvoline, the quick, easy, and trusted name in preventive vehicle maintenance, leads the industry with automotive service innovations that simplify customers’ lives and take the anxiety out of vehicle care. The company operates and franchises over 1,700 service center locations through its Valvoline Instant Oil ChangeSM and Great Canadian Oil Change retail sites, and it supports over 250 locations through its Express Care platform.

Mary Meixelsperger has been the chief financial officer of Valvoline Inc. since June 2016. She is in charge of the company’s global financial and information technology organizations, which include financial accounting and reporting, treasury and financial planning and analysis, risk management and credit, business development, investor relations, tax, and internal audit. Before joining Valvoline, Meixelsperger was senior vice president and chief financial officer of DSW Inc., a prominent branded footwear and accessories omni-channel retailer. Meixelsperger holds a bachelor’s degree in accounting with honors from the University of Wisconsin-Madison and is a certified public accountant (inactive).

Opinion: Its hard to like the narrative. EV vehicles don’t need oil changes.

Name: Steven D Fredrickson

Position: Chairman

Transaction Date: 2023-08-29 Shares Bought: 26,000 Average Price Paid: $19.31 Cost: $502,060

Company: Pra Group Inc (PRAA)

PRA Group Inc. is a multinational financial and business services firm operating in the Americas, Europe, and Australia. Their principal activity is acquiring, collecting, and administering nonperforming loan portfolios. They generally buy unpaid debts owed by individuals to credit originators, including banks and other consumer, retail, and auto lending organizations. The company buys nonperforming loan portfolios at a discount in two primary categories: Core and Insolvency. The core company specializes in purchasing and collecting nonperforming loans acquired after credit originators and other third-party collection agencies could not collect the total owing. The Insolvency operation largely comprises purchasing and collecting on nonperforming loan accounts whose customers are involved in a bankruptcy case or the equivalent in some European countries.

Steve Fredrickson has been the Company’s Chairman of the Board since April 2020. He served as Executive Chairman of the Board from June 2017 to his current position, and he was Chairman and CEO from 2002 to June 2017. Before joining PRA, Fredrickson worked for Household International in different business divisions responsible for troubled consumer, commercial, and commercial real estate debt. Previously, he worked at Continental Bank of Chicago, specializing in corporate and real estate workouts. Fredrickson’s current community participation includes serving on the boards of directors for the United Way of South Hampton Roads Foundation and St. Mary’s Home Foundation, as well as the board of trustees for Eastern Virginia Medical School Foundation. He holds an MBA from the University of Illinois and a BSBA from the University of Denver.

Opinion: Successful investing must consider the narrative of the stock. Although it certainly makes sense to me that the collection business should be looking up, I have a hard time getting excited about owning a company in that very unglamorous business. Narratives are important to any stock market valuation but don’t lend themselves to mathematics and financial ratios.

Name: John W Childs

Position: Director

Transaction Date: 2023-08-30 Shares Bought: 50,000 Average Price Paid: $18.44 Cost: $922,180

Company: Biohaven Ltd. (BHVN)

Biohaven Ltd. is a global clinical-stage biopharmaceutical company dedicated to studying, developing, and commercializing life-changing therapies for people suffering from debilitating neurological and neuropsychiatric diseases, particularly uncommon ones. Their expert management team has a track record of obtaining novel pharmaceutical approvals for conditions like migraines, depression, bipolar disorder, and schizophrenia. They are advancing a pipeline of therapies for diseases with few or no treatment options, including Kv7 ion channel modulation for epilepsy and neuronal hyperexcitability, glutamate modulation for Obsessive-Compulsive Disorder and Spinocerebellar Ataxia, myostatin inhibition for neuromuscular diseases, and brain-penetrant antibodies. Janus Kinase/Tyrosine Kinase TRPM3 channel activation for neuropathic pain, CD-38 antibody recruitment, and bispecific medicines for multiple myeloma, cancer, and autoimmune illnesses are among their early- and late-stage product candidates.

Mr. John W. Childs is the Chairman and Partner of the private equity firm J.W. Childs Associates, L.P. In 1995, he co-founded J.W. Childs Associates. Mr. Childs spent seventeen years with the Prudential Insurance Company of America, where he held numerous senior roles in the investment business, eventually culminating as Senior Managing Director in charge of the Capital Markets Group. He serves as Chairman of Sunny Delight and on the boards of Kosta Browne, Esselte, Mattress Firm, WS Packaging, and SIMCOM. He was the Chairman of the Board of CHG Healthcare Services before its sale. Mr. Childs graduated from Yale University with a B.A. and from Columbia University with an M.B.A.

Opinion: Childs knocked the ball out of the park by buying Bioven after Pfizer purchased the Company primarily for its migraine Nurtec franchise. I did not even know that there was a company left as the financial media portrayed it as Pfizer buying the whole company. This looks like a buying opportunity.

Name: Robert Michael McKee

Position: President & CEO

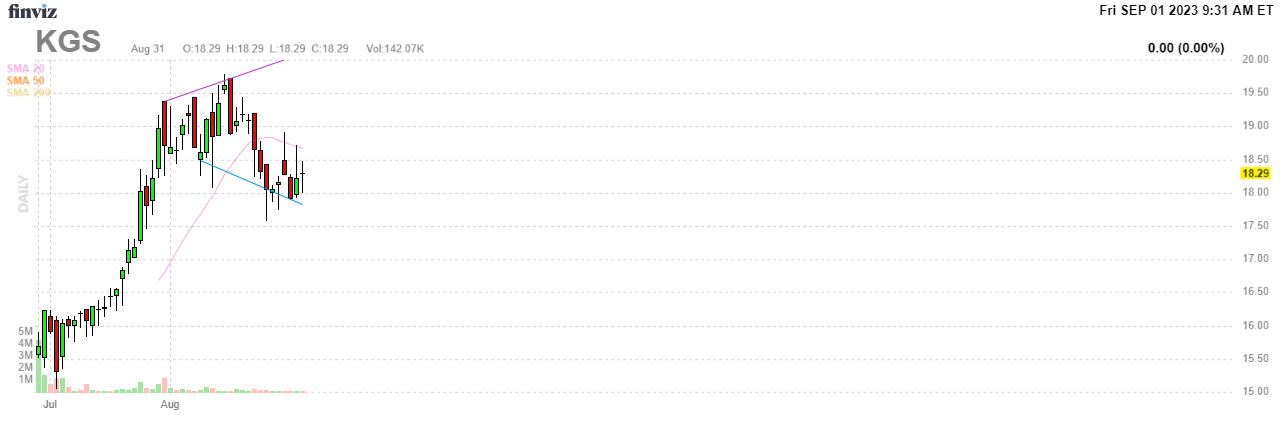

Transaction Date: 2023-08-23 Shares Bought: 16,180 Average Price Paid: $18.05 Cost: $292,033

Company: Kodiak Gas Services Inc. (KGS)

Kodiak Gas Services, Inc. manages contract compression infrastructure for customers in the oil and gas business in the United States. It operates in two segments: compression operations and other services. The Compression Operations division manages company-owned and customer-owned compression infrastructure to facilitate natural gas and oil production, collection, and transportation. The Other Services division offers contract services such as station building, maintenance and overhaul, and other auxiliary time and material-based solutions. Frontier TopCo, Inc. was the previous name of the corporation. Kodiak Gas Services, Inc. was founded in 2010 and is headquartered in Montgomery, Texas. Kodiak Gas Services, Inc. is a Frontier Topco Partnership, L.P. subsidiary.

Mickey McKee is the President and Chief Executive Officer of Kodiak. Kodiak Gas Services was founded in June 2011 by Robert ‘Mickey’ McKee, who has served as its President since 2011 and Chief Executive Officer since 2019. He was the Senior VP of Sales and Engineering for CDM Resource Management, LLC (CDM) from 2003 to 2010 before co-founding predecessor in 2010. Mickey also oversaw the Engineering and Fleet Management groups, collaborated with vendors and OEM manufacturers, and oversaw the sales and marketing activities of some of CDM’s fastest-growing divisions, all while cultivating significant client relationships. Before that, Mickey spent two years in CDM’s Operations group researching, qualifying, and installing equipment throughout Texas and Louisiana. Mickey graduated from Tulane University with a Bachelor of Science in Mechanical Engineering.

Opinion: It’s bullish behavior when insiders purchase stock AFTER their company’s IPO at higher prices. You can be an insider, too– by clicking here

Name: Prashant Aggarwal

Position: Director

Transaction Date: 2023-08-28 Shares Bought: 96,900 Average Price Paid: $10.34 Cost: $1,001,655

Company: Lyft Inc. (LYFT)

Lyft, Inc. paved the way for a mobility revolution. The company founded the peer-to-peer marketplace for on-demand ridesharing in 2012 and has since continued to pioneer innovations that line with their goal. Lyft is now one of the most widespread multimodal transportation networks in the United States and Canada. The world is on the verge of shifting away from car ownership and towards Transportation-as-a-Service. Lyft is at the forefront of this enormous societal transformation. The company’s ridesharing marketplace encourages users to drive less. It offers a realistic alternative to car ownership while offering drivers who use its platform the freedom and independence to select when, where, how long, and on what platforms they work.

Mr. Prashant Aggarwal is an Independent Director of Arlo Technologies, Inc., an Independent Non-Executive Director of Yatra Online, Inc., the CEO of Soar Capital LLC, and the Chairman of Lyft, Inc. He serves on the boards of Thumbtack, Inc., Arlo Technologies, Inc., and Yatra Online, Inc. Mr. Aggarwal formerly worked for Trulia, Inc. as Chief Financial Officer, PayPal Holdings, Inc. as Vice president, PayPal, Inc. as Chief Accounting Officer & Vice President-Finance, eBay, Inc. as Vice President-Finance, and Amazon.com, Inc. as Director-Finance. He obtained his undergraduate degree from The College of Wooster and his graduate degree from Kellogg School of Management.

Opinion: It’s the narrative again. It’s hard to attribute long-term value to Uber and Lyft when Tesla, GM’s Cruise, and Alphabet’s Waymo are expanding truly autonomous city driving.

Name: Jennifer C Witz

Position: CEO

Transaction Date: 2023-08-28 Shares Bought: 250,000 Average Price Paid: $4.11 Cost: $1,026,900

Company: Sirius Xm Holdings Inc. (SIRI)

SiriusXM Holdings was established in Delaware on May 21, 2013. Holdings has no businesses other than its wholly owned subsidiaries, Sirius XM and Pandora. The company has two complimentary radio entertainment businesses: Sirius XM and Pandora & Off-platform. They are the leading audio entertainment company in North America, with a portfolio of audio businesses that includes Sirius XM, Pandora’s ad-supported and premium music streaming services, a podcast network, an advertising sales group called SXM Media, and a suite of advertising technology solutions. We estimate that we reach around 150 million listeners monthly. They are always expanding their listeners’ options regarding appealing material and the variety of ways it can be received.

Ms. Jennifer C. Witz is an Independent Director at LendingTree, Inc., an Executive Vice President and Chief Marketing Officer at Sirius XM Holdings, Inc., and president of marketing and Operations at Sirius XM Radio, Inc. She serves on the boards of LendingTree, Inc. and Sirius XM Holdings, Inc. Ms. Witz formerly worked for New Viacom Corp. as a Vice President-Planning and Development and Metro-Goldwyn-Mayer, Inc. as a Vice President-Finance and Corporate Development. She was also a member of The Advertising Council, Inc.’s board of directors. She obtained her undergraduate degree from the University of Pennsylvania’s Wharton School and her MBA from Harvard Business School.

Opinion: Siri round-tripped on Q2 earnings. No idea why, but 25% short interest ratio can explains some behavior.

Name: Robert Carey

Position: Director

Transaction Date: 2023-08-28 Shares Bought: 250,000 Average Price Paid: $2.70 Cost: $673,750

Company: Beyond Air Inc. (XAIR)

Beyond Air is a commercial-stage medical device and biopharmaceutical firm creating a platform of nitric oxide generators and delivery devices capable of producing NO from ambient air (the “LungFit® platform”). Their first device, LungFit® PH, obtained FDA premarket approval in June 2022. In conjunction with ventilatory support and other appropriate agents, the NO generated by the LungFit® PH system is indicated to improve oxygenation and reduce the need for extracorporeal membrane oxygenation in term and near-term neonates with hypoxic respiratory failure associated with clinical or echocardiographic evidence of pulmonary hypertension. In July 2022, the Company began marketing LungFit® PH as a medical device in the United States for PPHN. LungFit® can be used to treat patients on ventilators who require NO and patients with chronic or acute severe lung infections using a breathing mask or similar device.

Mr. Carey joined the Beyond Air Board of Directors in February 2019. He has a long track record of success in the biopharmaceutical and healthcare investment banking industries. Mr. Carey co-founded and served as President and Chief Operating Officer of ACELYRIN, INC. in 2020, a biopharmaceutical business that will invest in, develop, and commercialize life-changing medical medicines. Mr. Carey served as Executive Vice President and Chief Business Officer at Horizon Therapeutics plc from March 2014 until September 2019. Before joining Horizon, he was Managing Director and Head of the Life Sciences Investment Banking Group at JMP Securities for almost 11 years. He earned his BBA in Accounting from the University of Notre Dame. Mr. Carey now serves on the boards of Sangamo Therapeutics, Inc., FS Development Corp., and Hawthorne Race Course, Inc.

Opinion: Carey has been buying this stock on the down escalator. I don’t see any reason to follow him.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders made some notable gains last week. You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,