Insider buying has been noticeably scarce in this bull leg of a market making all-time highs. The small amount of buying is not performing particularly well either. You might find this news surprising from a hedge fund manager who has made a living reading these tea leaves for 23 years.

Name: Ole G Rosgaard

Position: President and CEO

Transaction Date: 2024-03-08 Shares Bought: 4,914 Average Price Paid: $67.00 Cost: $329,235

Company: Greif Inc (GEF)

Greif Inc. is a top global provider of industrial packaging goods and services, with operations in over 35 countries. The company provides a wide range of rigid industrial packaging products, including steel, fibre, and plastic drums, rigid intermediate bulk containers, jerrycans, and other small plastics, closure systems for industrial packaging products, transit protection products, water bottles, and remanufactured and reconditioned industrial containers, as well as services such as container life cycle management, filling, logistics, warehousing, and other packaging services. The company manufactures and distributes containerboard, corrugated sheets, corrugated containers, and other corrugated goods to customers in North America in industries like packaging, automotive, food, and construction. They also make and sell coated and uncoated recycled paperboard, some of which are utilized to manufacture and sell industrial items. In addition, the company buys and sells recovered fibre, as well as manufactures and sells adhesives for their paperboard goods.

Ole Rosgaard is Greif’s President and CEO. Since 2015, he has been the Vice President and Division President of Greif’s Rigid Industrial Packaging – North America business unit. He also worked as Senior Vice President and Group President of Global Industrial Packaging, where he oversaw all Rigid, Flexible, and Accessory packaging operations worldwide before becoming COO. Furthermore, from 2016 to 2019, Ole oversaw the development of the company’s Sustainability program, propelling it to an industry-leading position. Ole has a unique perspective and extensive experience leading cross-cultural people and teams around the world, having lived in five countries and worked on five continents for both family- and private-equity-owned companies. He is a dedicated lifelong learner who has completed multiple executive programs at major institutions such as Harvard Business School and other leading European organizations.

Opinion:

Name: Jeffrey M Blackburn

Position: Director

Transaction Date: 2024-03-13 Shares Bought: 8,000 Average Price Paid: $63.96 Cost: $511,680

Company: Roku Inc (ROKU)

Roku, Inc., along with its subsidiaries, operates a TV streaming platform in the United States and overseas. Platform and Devices are the company’s two business segments. Its streaming platform enables users to discover and access TV series, movies, news, sports, and other content. The Platform segment provides digital advertising, including direct and programmatic video advertising, media and entertainment promotional spending, and related services, as well as streaming service distribution, which includes subscription and transaction revenue shares, premium subscription sales, and branded app buttons on remote controls. The Devices sector sells streaming players, Roku-branded televisions, smart home goods and services, audio equipment, and related accessories, as well as licensing agreements with service providers. Roku, Inc. was established in 2002 and is based in San Jose, California.

Jeff Blackburn joined the Roku board in June 2023. Jeff has been with Amazon.com, Inc. for over two decades and has been a member of its senior leadership team for more than a decade. He was Senior Vice President of Global Media and Entertainment from May 2021 to February 2023 and Senior Vice President of World Wide Business Development, Advertising, and Entertainment from November 2012 to February 2020. Mr. Blackburn earned an M.B.A. from Stanford Business School and an A.B. in economics from Dartmouth College.

Opinion:

Name: Christopher M Lal

Position: CLO & Corp. Secretary

Transaction Date: 2024-03-08 Shares Bought: 9,156 Average Price Paid: $48.16 Cost: $440,953

Company: Alteryx Inc. (AYX)

The Alteryx Analytics Automation Platform makes “analytics for all” a reality by automating data engineering, analytics, reporting, machine learning, and data science activities from start to finish. The company’s platform enables businesses to democratize data analytics across their organizations for a variety of use cases by adding embedded artificial intelligence (AI) capabilities that speed up the discovery and sharing of analytics insights. Data professionals, regardless of technical expertise, are enabled to discover insights and solve problems, whether they operate in the cloud or on-premise. The platform offers insight-driven businesses a unified solution for automated data preparation and analytics, approachable machine learning, and AI-generated insights. The company platform is widely distributed via both direct and indirect sales and marketing methods.

Christopher Lal is Alteryx’s chief legal officer, overseeing all legal matters, including intellectual property, licensing, contract negotiations, privacy, compliance, and corporate governance. Chris has over 25 years of experience as a corporate, transactional, and securities attorney, representing both public and private companies at all stages of development and expansion. Chris previously worked as vice president, general counsel, and secretary of Tilly’s, Inc., an NYSE-traded retail and e-commerce company, where he was in charge of SEC and NYSE compliance, intellectual property, Federal Trade Commission matters, e-commerce, and labor and employment. Chris began his career at O’Melveny & Myers, LLP, where he worked in the corporate and securities practice, advising clients on public and private securities issues, corporate financing transactions, mergers and acquisitions, and corporate governance. Chris has a B.A. from the University of California, Santa Barbara, and a J.D. from the University of Southern California.

Opinion: I am shocked. The deal closed as expected. I still have no idea why the insider would buy the stock with pennies to gain unless there was some special arrangement that they didn’t have to cash out and could carry their interest into Newco unlike the public shareholders. This would be a clear violation of the terms of the merger agreement so it’s not likely.

Name: R David Hoover

Position: Director

Transaction Date: 2024-03-06 Shares Bought: 20,000 Average Price Paid: $16.14 Cost: $322,808

Company: Elanco Animal Health Inc (ELAN)

Elanco Animal Health Incorporated and its subsidiaries are a global leader in animal health, committed to developing and delivering products and services to prevent and treat disease in farm animals and pets. The company collaborates with farmers, pet owners, veterinarians, and society to add value and assist their customers in improving the health of the animals in their care, while also having a significant impact on the communities we serve. The company’s diverse, long-lasting product portfolio is distributed in over 90 countries and serves animals of many types, including dogs and cats, cattle, poultry, swine, sheep, and aquaculture. With this ability to reach the world’s animals, they are devoted to achieving their customer promise: to be your advocate and continue to earn your confidence by improving animal health and providing value through new products, expertise, and services. The company operates as a single section of the animal health industry, committed to achieving their vision of Food and Companionship Enriching Life.

R. David Hoover has been the Chairman of the Elanco Board of Directors since September 2018. Hoover departed as CEO of Ball Corporation in 2011 after 41 years of leadership. Hoover joined Ball Corporation in 1970 and held several leadership positions during his tenure, including Vice President of Finance and Administration for both the company’s agricultural and aerospace systems divisions, Vice President and Treasurer, Senior Vice President and Chief Financial Officer, and Chief Operating Officer, among others. Hoover has previously served on the boards of directors for Edgewell Personal Care, Eli Lilly and Company, Ball Corporation, and Steelcase Inc. Hoover serves as an advisory trustee at DePauw University and on the Dean’s Council of Indiana University’s Kelley School of Business. He earned a bachelor’s degree from DePauw University and an MBA from Indiana University.

Opinion:

Name: James Defranco

Position: Director

Transaction Date: 2024-03-06 Shares Bought: 90,000 Average Price Paid: $13.21 Cost: $1,188,600

Company: EchoStar CORP (SATS)

EchoStar Corporation is a holding company that was incorporated in October 2007 under Nevada law. EchoStar Corporation is a leading global provider of satellite communications technologies. EchoStar is a pioneer in secure communications technologies, with headquarters in Englewood, Colorado, and operations worldwide. The company’s main executive offices are located at 9601 South Meridian Boulevard in Englewood, Colorado. On December 31, 2023, they completed the acquisition of DISH Network under the Amended and Restated Agreement and Plan of Merger, dated October 2, 2023, by and among them, EAV Corp., a Nevada corporation and their wholly owned subsidiary, and DISH Network, under which the acquired DISH Network through the merger of Merger Sub with and into DISH Network, with DISH Network surviving the Merger as their wholly owned subsidiary.

James DeFranco joined the board in December 2023, following the merger of EchoStar and DISH Network Corporation. Mr. DeFranco is one of our Executive Vice Presidents, having previously served as a vice president for DISH Network Corporation and as a member of the Board since its inception. He has held a variety of executive and director positions with DISH Network and its subsidiaries over the last five years. In 1980, Mr. DeFranco co-founded DISH Network with Charles W. Ergen and Cantey M. Ergen.

Opinion:

Name: Quentin S. Blackford

Position: Director

Transaction Date: 2024-03-07 Shares Bought: 20,000 Average Price Paid: $12.83 Cost: $256,600

Company: Alphatec Holdings Inc. (ATEC)

Alphatec Holdings Inc. is a medical technology business headquartered in Carlsbad, California, dedicated to the creation, development, and advancement of technology for improved surgical treatment of spinal problems. The company hopes to alter the approach to spine surgery through clinical differentiation by combining our unique, 100% spine emphasis and vast, collective industry knowledge. The company’s innovative approaches interact with its Alpha InformatiX™ product platform to improve the predictability and reproducibility of spine surgical outcomes. They have a broad product portfolio designed to address the many disorders of the spine, and they are always developing to achieve the ultimate goal of becoming the standard bearer in spine care.

Quentin Blackford has been a Director since October 2017. He is presently the CEO of iRhythm Technologies, Inc., a leading digital healthcare solutions firm focused on the enhancement of cardiac care. Before joining iRhythm in October 2021, Mr. Blackford was Chief Operating Officer and Chief Financial Officer of DexCom, Inc., a company that develops and markets continuous glucose monitoring systems for ambulatory use by diabetics and healthcare professionals. Before joining DexCom, Inc. in August 2017, Mr. Blackford was the Executive Vice President, Chief Financial Officer, and Head of Strategy and Corporate Integrity at NuVasive, Inc., a medical device company that focuses on developing minimally disruptive surgical products and procedures for the spine. He previously worked for Zimmer Holdings, Inc., most recently as Director of Finance and Controller for Zimmer’s Dental Division. He received his Certified Public Accounting credential after earning dual B.S. degrees in Accounting and Business Administration, with a focus in Accounting, from Grace College.

Opinion:

Name: John Ho

Position: Chief Executive Officer

Transaction Date: 2024-03-08 Shares Bought: 17,241 Average Price Paid: $11.60 Cost: $199,996

Company: Landsea Homes Corp (LSEA)

Name: Michael Forsum

Position: President and COO

Transaction Date: 2024-03-08 Shares Bought: 17,241 Average Price Paid: $11.60 Cost: $199,996

Company: Landsea Homes Corp (LSEA)

Name: Mollie Fadule

Position: Director

Transaction Date: 2024-03-08 Shares Bought: 8,621 Average Price Paid: $11.60 Cost: $100,004

Company: Landsea Homes Corp (LSEA)

Landsea Homes Corporation is a publicly traded residential homebuilder headquartered in Dallas, Texas, that designs and constructs best-in-class houses and sustainable master-planned communities in some of the nation’s most coveted markets. The corporation has built houses and communities in New York, Boston, New Jersey, Arizona, Colorado, Florida, Texas, and Silicon Valley, as well as Los Angeles and Orange County, California. Landsea Homes was named the Green Home Builder 2023 Builder of the Year after winning the renowned Builder of the Year award in 2022, which was granted by BUILDER magazine in appreciation of a historic year of transformation. The company thinks that all of the experience, innovation, and care that goes into designing and building your new home should be felt and sensed right away, and for many years to come. They design and create homes and communities across the country that reflect spaces inspired by modern living and are in dynamic, prime locations where the homes link effortlessly with their surroundings and enrich the local lifestyle for living, working, and playing.

John Ho has been the CEO and Director of Landsea Homes since 2013. John Ho spent ten years in real estate investment and development with Colliers International and Jones Lang LaSalle before founding Landsea Homes. From 2011 to 2013, he was Director of JLL and from 2008 to 2011, Vice President. During that period, he was in charge of the firm’s foreign business growth, which focused on providing transactional, consulting, and other integrated real estate services to businesses investing overseas. John Ho holds a bachelor’s degree from the University of Southern California and an MBA from UCLA Anderson School of Management.

Mike Forsum is Landsea Homes’ President and Chief Operating Officer. Before joining Landsea Homes in 2016, Forsum worked as a partner in private equity for seven years, specialized in residential real estate investing, and co-founded Starwood Land Ventures in 2008, an affiliate of Starwood Capital Group Global. He has over 30 years of experience as a senior executive in the homebuilding sector, having led homebuilding operations at KB Homes, Division President of Ryland Homes, and West Region President and member of the North American leadership team at Taylor Woodrow/Morrison. Forsum serves on the National Board of Directors for HomeAid America and holds a bachelor’s degree from Arizona State University.

Fadule is the current Chief Financial and Investment Officer for JPI, a developer, builder, and investment manager. She is also the founder and partner of Cephas Partners, a private equity business that specializes in alternative investments, with a particular emphasis on real estate-related opportunities. Since 2015, she has invested in and advised several firms that bring innovative technologies to the real estate and construction industries. Before co-founding Cephas Partners, Fadule was a Vice President in Bank of America Merrill Lynch’s Real Estate Principal Investments division in New York. She previously served on the Global CREW Network Board, which represented more than 11,000 women in commercial real estate.

Opinion:

Name: Christian Devin Ruppel

Position: Chief Revenue Officer

Transaction Date: 2024-03-11 Shares Bought: 33,000 Average Price Paid: $9.07 Cost: $299,144

Company: Green Dot Corp (GDOT)

Green Dot Corporation, established in 1999, is a financial technology and licensed bank holding business dedicated to providing all people with the ability to bank seamlessly, inexpensively, and with confidence. The company’s technological platform allows them to create products and features that address the most pressing financial concerns for consumers and businesses, revolutionizing how they handles and move money and making financial empowerment more accessible to all. As the regulated entity and issuing bank for the substantial majority of products and services the company provides, whether their own or on behalf of their partners, they are directly accountable for all aspects of each program’s integrity, including ensuring the program’s compliance with all applicable banking regulations, state and federal law, and various internal governance policies and procedures, as well as deploying enterprise-class risk management practices and procedures.

As Chief Revenue Officer, Chris is in charge of directing all revenue-generating companies, marketing, and products, with a strategic focus on driving consistent revenue and margin expansion throughout the enterprise. Chris formerly worked as General Manager of the company’s direct-to-consumer division, where he focused on accelerating the growth of the company’s main digital bank, GO2bank, which launched in early 2021. He was previously the General Manager of Prepaid Cards for the Americas at WEX Inc. As part of WEX’s global development in the Americas, the company’s prepaid card business expanded into Brazil with the acquisition of FastCred and a majority stake in UNIK. Chris previously served as CEO and co-founder of Quick! Financial Services from 2004 until it was bought by WEX in April 2011. From 1996 to 2008, he was vice president of Sembler Investments and held executive positions in several portfolio firms. Chris graduated from Florida State University with a B.A. in Finance and a B.A. in English and currently resides in Tampa, Florida.

Opinion:

Name: Jon Feltheimer

Position: Chief Executive Officer

Transaction Date: 2024-03-07 Shares Bought: 100,000 Average Price Paid: $8.84 Cost: $884,000

Company: Lions Gate Entertainment Corp (LGF-B)

Lions Gate Entertainment Corporation was founded in 1986 and is based in Santa Monica, California. Lions Gate Entertainment Corp. operates in the film, television, subscription, and location-based entertainment industries in the United States, Canada, and abroad. The corporation is divided into three business segments: motion pictures, television production, and media networks. The Motion Picture segment creates and produces feature films, acquires North American and global distribution rights, distributes North American feature films through theatres, home entertainment, and television, and licenses distribution rights to global feature films. Television Production develops, produces, and distributes series, movies, miniseries, and non-fiction content worldwide. Media Networks sells STARZ-branded premium subscription video services locally and globally via over-the-top platforms and video programming distributors like cable operators, satellite TV providers, and telecommunications companies.

Jon Feltheimer Currently serves as CEO and Non-Independent Executive Director at Lions Gate Entertainment Corp. He also serves on the boards of ten other firms. Mr. Feltheimer previously worked at Sony Pictures Entertainment for nine years as president of the Columbia TriStar Television Group, where he oversaw the launch of roughly 30 branded channels throughout the world. While at Sony, he oversaw the company’s 1997 acquisition of Telemundo Group, a Spanish-language broadcaster, in collaboration with Liberty Media and Apollo Management. He has received MIPCOM’s prestigious “Personality of the Year” Award, been inducted into Broadcasting & Cable’s Hall of Fame, received NATPE’s prized Brandon Tartikoff Legacy Award, the Producers Guild of America Milestone Award, and the Simon Wiesenthal Centre Humanitarian of the Year Award.

Opinion:

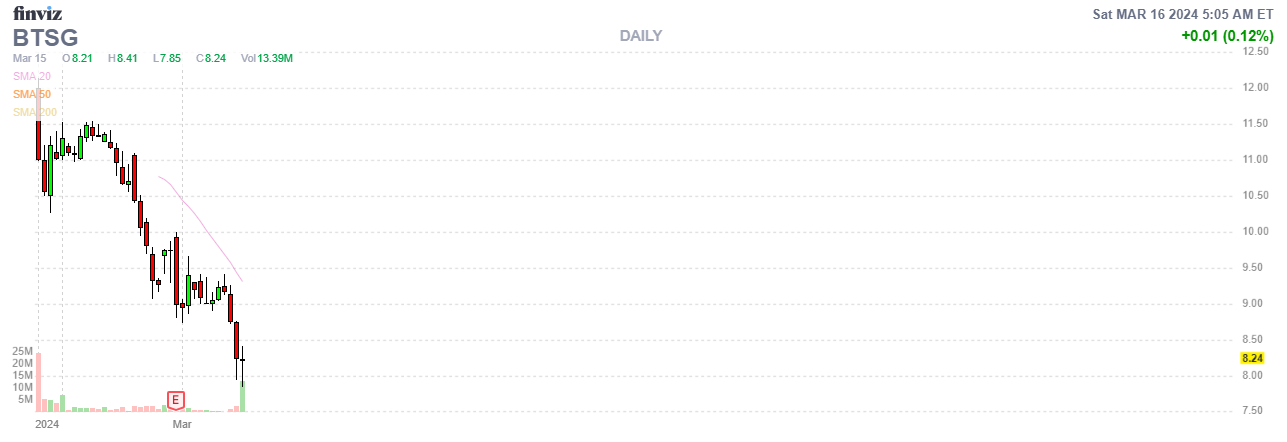

Name: James F Jr Mattingly

Position: Executive Vice President & CFO

Transaction Date: 2024-03-14 Shares Bought: 12,280 Average Price Paid: $8.18 Cost: $100,450

Company: BrightSpring Health Services Inc. (BTSG)

Name: Jennifer A Phipps

Position: Chief Accounting Officer

Transaction Date: 2024-03-14 Shares Bought: 12,300 Average Price Paid: $8.14 Cost: $100,122

Company: BrightSpring Health Services Inc. (BTSG)

Name: Jon B Rousseau

Position: President & Chief Executive Officer

Transaction Date: 2024-03-14 Shares Bought: 37,405 Average Price Paid: $8.12 Cost: $303,729

Company: BrightSpring Health Services Inc. (BTSG)

BrightSpring Health Services, Inc. was formed in 1974 and is headquartered in Louisville, Kentucky. The company was previously known as Phoenix Parent Holdings Inc. before changing its name to BrightSpring Health Services, Inc. in May 2021. They are a leading home and community-based healthcare services platform that focuses on providing complementary pharmacy and provider services to complicated patients. The company takes a unique approach to care delivery, using an integrated and scalable model to address vital services that the highest-need and highest-cost patients require. With an emphasis on Senior and Specialty patients, including Behavioural populations, their platform offers pharmacy and provider services in low-cost home and community settings to Medicare, Medicaid, and commercially insured patients. The company methodology focuses on providing high-touch and coordinated services to medically difficult customers and patients, a sizable, expanding, and underserved population in the United States healthcare system.

Jim Mattingly has been the Executive Vice President and CFO since October 2017. Mr. Mattingly was senior vice president and chief financial officer of Kindred Rehabilitation Services from April to October 2017, before joining the company. Mr. Mattingly previously served as vice president and chief financial officer at Kindred Rehabilitation Services from October 2015 to April 2017, as well as vice president of finance and controller for Kindred at Home and several senior financial positions at Fortune Brands and Yum! Mr. Mattingly earned a Bachelor of Arts in economics and philosophy from Bellarmine University and a Master of Business Administration from Indiana University Bloomington.

Jennifer Phipps currently serves as the Chief Accounting Officer for BrightSpring Health Services, Inc. Jen Phipps, Chief Accounting Officer, was named to Leadership Louisville’s Elevate: A Women’s Leadership Council. The council is made up of Louisville’s finest female leaders who will counsel and support the Alice Houston Women’s Leadership Program participants.

Jon Rousseau has been the President and CEO and a member of the board of directors since September 2016. Mr. Rousseau was an executive vice president at Kindred Healthcare, Inc. from June 2013 to July 2016, where he held several leadership positions, including president of Kindred Rehabilitation Services and, before that, president of the Care Management Division and Kindred at Home, Kindred’s home health, hospice, home care, and home-based primary care businesses. Before Kindred, Mr. Rousseau held several senior leadership positions at other market-leading healthcare product and technology companies, including vice president of global marketing, strategy, and commercial development at Mylan, Inc. and global senior director of the continuous glucose monitoring franchise at Medtronic PLC (2006-2013). He earned his MBA from Harvard Business School and his A.B. from Princeton University.

Opinion:

Name: Harris N Williams

Position: Director

Transaction Date: 2024-02-29 Shares Bought: 12,000 Average Price Paid: $8.10 Cost: $97,200

Company: Gogo Inc. (GOGO)

Gogo is the world’s leading provider of internet connectivity solutions for the business aviation market. The company has been in this market for about 25 years. Their goal is to improve passengers’ lives and operators’ efficiency by offering the world’s best business aviation in-flight connectivity and customer care. They have always strived to provide the best connectivity for the business aviation industry, regardless of technology, and they have a demonstrated track record of doing so. Gogo started with analog air-to-ground technology in the late 1990s, then switched to narrowband satellite connectivity in the early 2000s as analog cellular backhaul became obsolete, and finally returned to ATG with digital broadband 3G and 4G networks in 2010. The business plans to implement its fourth ATG network, Gogo 5G, in the fourth quarter of 2024. Gogo is working with a subset of AVANCE clients and customers who use Gogo Biz ATG aerial technology on their terrestrial 3G and 4G networks to upgrade to an LTE-compatible system while developing Gogo 5G.

Harris N. Williams has served on the Board of Directors since March 2010. Mr. Williams is currently the Senior Managing Director of WF Investment Management LLC, a diverse asset management organization. Mr. Williams worked at Ripplewood Holdings, LLC, a global private equity firm specializing in control investments, from 2005 to 2013, and has been the Managing Director since 2007. Before 2005, Mr. Williams worked at Credit Suisse’s Investment Banking branch, where he was primarily responsible for mergers and acquisitions and leveraged buyouts. Mr. Williams’ global interests include technology, media, financial services, healthcare, industrials, and hospitality. Mr. Williams was on the board of directors of 3W Power Holdings Ltd. from 2011 to 2013, where he chaired the Audit Committee. Mr. Williams received his B.S. in Business Administration from Boston University and his M.B.A. from the Wharton School at the University of Pennsylvania.

Opinion:

Name: Mark J Foley

Position: CEO

Transaction Date: 2024-03-06 Shares Bought: 30,000 Average Price Paid: $6.98 Cost: $209,400

Company: Revance Therapeutics Inc. (RVNC)

Revance Therapeutics, Inc. is a biotechnology business that develops, manufactures, and commercializes neuromodulators for a variety of aesthetic and therapeutic applications in the United States and internationally. DAXXIFY for injection is the company’s lead drug candidate for the treatment of glabellar lines and cervical dystonia; it has completed phase II clinical trials for the treatment of upper facial lines, moderate or severe dynamic forehead lines, and moderate or severe lateral canthal lines; and it has completed phase II clinical trials for adult upper limb spasticity and plantar fasciitis. The company also provides Resilient Hyaluronic Acid dermal filler for the repair of moderate to severe dynamic face wrinkles and RHA Redensity, a dermal filler for the treatment of moderate to severe dynamic perioral rhytids. The company was previously known as Essentia Biosystems, Inc., but changed its name to Revance Therapeutics, Inc. in April 2005. Revance Therapeutics, Inc. was established in 1999 and is based in Nashville, Tennessee.

Mark J. Foley is Revance Therapeutics’ CEO and a member of the board of directors since September 2017. Previously, Mr. Foley was the Chairman, President, and CEO of ZELTIQ Aesthetics. From 2004 to 2018, Mr. Foley was the Managing Director of RWI Ventures, a venture capital firm that invested in life sciences, networking, semiconductors, and software. Mr. Foley has over 25 years of experience in the healthcare industry, having held senior operating positions in both large public companies and venture-backed startups, including U.S. Surgical Corporation, Guidant Corporation, Devices for Vascular Intervention, Perclose, and Ventrica, where he was the founder and CEO. Mr. Foley now serves on the board of directors for Glaukos Corp., an ophthalmic medical technology and pharmaceutical firm, and formerly served on the board of directors for SI-BONE, a medical device manufacturer. Mr. Foley obtained his bachelor’s degree from the University of Notre Dame.

Opinion:

Name: Nicolas Finazzo

Position: Chairman & CEO

Transaction Date: 2024-03-12 Shares Bought: 35,800 Average Price Paid: $6.88 Cost: $246,220

Company: AerSale Corp (ASLE)

AerSale Corporation was created in 2008 and has its headquarters in Coral Gables, Florida. The company offers aftermarket commercial aircraft, engines, and parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, government and defense contractors, and maintenance, repair, and overhaul service providers around the world. It operates in two segments: Asset Management Solutions and Technical Operations. The Asset Management Solutions division sells and leases airplanes, engines, and airframes, and disassembles them for component components. The TechOps section offers internal and third-party aviation services, such as internally created engineered solutions, heavy aircraft repair and modification, component MRO, and end-of-life disassembly services. This division specializes in aircraft modifications, cargo and tanker conversions, aircraft storage, and MRO services for landing gear, thrust reversers, hydraulic systems, and other aircraft components.

Nicolas Finazzo has over 30 years of experience in aircraft leasing, financing, maintenance, and airline operations. Nicolas founded a commercial aircraft leasing company early in his career, which later grew into Air Florida Commuter, a regional airline. In 1992, he joined International Air Leases as Vice President and was elevated to Corporate General Counsel in 1994, where he oversaw a commercial aircraft portfolio of 200. In 1997, he cofounded and became CEO of AeroTurbine, Inc., the first non-OEM aftermarket startup to merge aircraft and engine sales, leasing, parts sales, and aviation maintenance and repair into a single integrated platform. After selling AeroTurbine in 2006, he and his business partner, Bob Nichols, founded AerSale® in 2008. Nicolas has a Juris Doctorate from the University of Miami School of Law and a Bachelor of Science in Political Science from the University of Michigan.

Opinion:

Name: Stellantis N.V. / FCA US LLC / FCA North America Holdings LLC / FCA Foreign Sales Holdco LTD. / SFS UK 1 LTD.

Position: 10% Owner

Transaction Date: 2024-03-08 Shares Bought: 1,600,000 Average Price Paid: $4.71 Cost: $7,539,040

Company: Archer Aviation Inc. (ACHR)

Archer Aviation Inc. designs and builds electric vertical takeoff and landing aircraft for urban air mobility networks. The company’s goal is to open the skies, allowing everyone to reimagine how they move and spend their time. Their eVTOL planes are designed to be safe, durable, and silent. Midnight’s production aircraft, which will be launched in November 2022, is built on their unique 12-tilt-6 configuration. This means that it has 12 propellers attached to 6 booms on a fixed wing, with all 12 propellers providing vertical lift during takeoff and landing, and the forward six propellers tilting forward to cruise position to provide propulsion during forward flight, while the wing provides aerodynamic lift as a conventional airplane. Midnight is intended to carry four people and a pilot for up to 100 miles at speeds of up to 150 mph, although it is ideally suited for back-to-back short-distance excursions of roughly 20 miles, with a charging time of about 10 minutes between journeys.

Stellantis is a collection of 14 historic automobile companies and two mobility arms dedicated to more than just transportation: moving people and building connections. Stellantis will work with Archer to develop the company’s previously announced production facility in Covington, Georgia, where the Midnight aircraft will be built in 2024. Midnight is designed to be safe, sustainable, and silent, and it can transport four passengers, including a pilot, and a cargo of more than 1,000 pounds. Midnight’s 100-mile range makes it suitable for back-to-back short-distance trips of roughly 20 miles, with a charge time of about 10 minutes in between. This one-of-a-kind cooperation in the urban air transportation industry will use each company’s assets and competencies to bring the Midnight aircraft to market. Archer will provide a world-class team of eVTOL, electric powertrain, and certification professionals to the alliance, while Stellantis will bring unique manufacturing technologies and skills, experienced persons, and financial resources.

FCA US LLC (FCA US), formerly Chrysler Group LLC, designs, engineers, produces, distributes, and sells automobiles. The firm sells passenger cars, minivans, sport utility vehicles, pickup trucks, and commercial vehicles under the brands Dodge, Jeep, Fiat, Mopar, Lancia, Chrysler, Ram, Abarth, and Alfa Romeo. In addition, the corporation offers retail and dealer financing, leasing, rental, and aftermarket services. It primarily operates in North America, selling its products in the United States, Canada, Mexico, and the Caribbean Islands. The company is a subsidiary of Fiat Chrysler Automobiles NV. FCA US is located in Auburn Hills, Michigan, United States.

FCA NORTH AMERICA HOLDINGS LLC is an active firm in the United States of America. It is distinguished by the legal entity identifier (LEI). The LEI is a one-of-a-kind code used to identify legal entities that participate in financial transactions around the world. FCA NORTH AMERICA HOLDINGS LLC is categorized as general and has the legal form code HZEH. The legal address of the entity is C/O THE CORPORATION TRUST COMPANY, 19801 WILMINGTON, Delaware, US, but the headquarters address is C/O THE CORPORATION COMPANY, 48178 SOUTH LYON, Delaware, US. The firm was founded on May 13, 2009, and was initially registered with an LEI on August 10, 2017, which is currently in effect and was last updated on June 1, 2023.

FCA FOREIGN SALES HOLDCO LIMITED is a registered corporation in the United Kingdom. The legal entity identification (LEI) is 549300FNR5QDOLC6SX24. The LEI is a one-of-a-kind code used around the world to identify legal organizations that participate in financial transactions. FCA FOREIGN SALES HOLDCO LIMITED works in the general category and has the legal form code H0PO. The entity’s legal address is 2 SUNBEAM WAY, CV3 1ND COVENTRY, Warwickshire, GB, and its headquarters are also located at the same address. The firm was founded on June 28, 2019, and was first registered with an LEI on June 23, 2022, which is now lapsed and last updated on June 23, 2022.

SFS UK 1 Ltd is an active company founded on November 12, 2021, with its registered office in Coventry, West Midlands. SFS UK 1 Ltd has been operating for two years. According to the most recent confirmation declaration dated November 11, 2023, there are now two active directors and one active secretary.

Opinion:

Name: Damien Lamendola

Position: Chief Executive Officer / 10% Owner

Transaction Date: 2024-03-07 Shares Bought: 910,000 Average Price Paid: $1.65 Cost: $1,501,500

Company: Marpai Inc. (MRAI)

Marpai Inc. is a technology-driven healthcare payer that employs artificial intelligence and data analytics to assist clients reduce healthcare costs while improving health outcomes for their employees and families. The company mission is to positively change healthcare for the benefit of (i) The Clients, who are self-insured employers that pay for their employees’ healthcare benefits and engage us to administer the latter’s healthcare claims, and they refer to them as “Clients”; (ii) employees and their family members who receive these healthcare benefits from the Clients, and they refer to them as “Members”; and (iii) healthcare providers, including doctors, doctor groups, hospitals, they are developing the future healthcare payer for self-insured firms in the United States, which they call the “Payer of the Future.” The company provides administrative services and functions as a third-party administrator for self-insured firms that offer healthcare benefits to their employees.

Damien Lamendola is a well-respected corporate executive with vast experience in the healthcare industry. Lamendola was appointed to Marpai’s Board of Directors on April 1, 2021, and brings a plethora of experience and skills to his new job as CEO. Lamendola founded Continental Benefits in 2013 and served as its CEO until 2019. Lamendola has been the President of HillCour Holding Corporation, originally Welldyne Holding Corp., since March 2002. Aside from his work as President, Lamendola has served on the board of HillCour Holding Corporation since 2017, displaying his dedication to leading and defining the company’s future. His board participation in WellDyneRx, LLC and HillCour Investment Fund, LLC since 2017 demonstrates his commitment and influence in these institutions. He received a Bachelor of Science from McNeese State University and later pursued an M.B.A. at Washington University.

Opinion:

Name: James F Lynch

Position: Director

Transaction Date: 2024-03-07 Shares Bought: 1,320,000 Average Price Paid: $1.32 Cost: $1,747,614

Company: Globalstar Inc. (GSAT)

Globalstar, Inc. is a top mobile satellite voice and data service provider. The company was founded in 1991 and is headquartered in Covington, Louisiana. Globalstar, Inc. provides Mobile Satellite Services via its satellite network, including voice and data communications and wholesale capacity services. The Globalstar System, which is a network of in-orbit satellites and functioning ground stations, provides various services. The company delivers dependable connections in places that are not serviced or underserved by terrestrial wireless and wireline networks, as well as when terrestrial networks are unavailable due to natural or man-made disasters. They meet their clients’ rising connectivity needs by providing wireless communications services around the world. Their competitive advantages are used through a shareholder value-enhancing strategy that focuses on four pillars: wholesale satellite capacity, terrestrial spectrum, IoT, and legacy services.

James F. Lynch has served as a director since December 2003. He has been the Managing Partner of Thermo Capital Partners, L.L.C. since October 2001, as well as a partner in Thermo Companies. Mr. Lynch was also the Executive Chairman and CEO of FiberLight, LLC, a facilities-based provider of metropolitan fiber-optic network infrastructure and high-bandwidth connectivity solutions, from 2015 to 2017. Mr. Lynch also served as Chairman of Xspedius Communications LLC, a competitive local telephone exchange carrier, from January 2005 until its acquisition by Time Warner Telecom in October 2006, as well as CEO of Xspedius from August 2005 to March 2006. Before joining Thermo Capital Partners, Mr. Lynch worked as a Managing Director for Bear Stearns & Co., an investment banking and brokerage firm.

Opinion:

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,