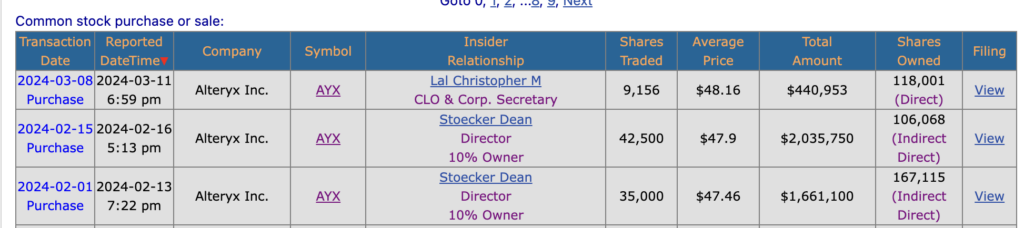

The sale is all cash for $48.25, yet insiders are buying it for as high as $48.16

Early on December 18, 2023, the Special Committee met, with Alteryx management and representatives of each of Wilson Sonsini and Qatalyst Partners in attendance. The representatives of Wilson Sonsini reviewed the final terms of the merger agreement, the voting agreement and the other related transaction documents. The representatives of Qatalyst Partners confirmed that Qatalyst Partners was prepared to deliver a written opinion that the per share price was fair, from a financial point of view, to the Alteryx stockholders, if and when requested by the Alteryx Board prior to the execution of the merger agreement. The Special Committee (1) determined that the merger agreement, and the transactions contemplated by the merger agreement, including the merger, were in the best interests of Alteryx and its stockholders; and (2) recommended that the Alteryx Board approve and declare advisable the merger agreement and authorize and approve Alteryx’s entry into the merger agreement (we refer to (1) and (2) as the “Special Committee approval”). The Special Committee did not determine to require the merger be approved by an affirmative majority vote of our stockholders that are disinterested with respect to the merger given that Mr. Stoecker had not entered into any arrangement or agreement with respect to a “rollover” in connection with the merger or to receive any benefits in the merger not shared by our stockholders generally.

https://www.sec.gov/edgar/search/#/dateRange=1y&ciks=0001689923&entityName=Alteryx%252C%2520Inc.%2520(AYX)%2520(CIK%25200001689923)

Opinion update 3/19/24: I am shocked. The deal closed as expected, with no superior offer. My only suspicion is that there was a possibility of a meaningful better bid, as many strategic and private equity investors were interested. No one stepped up, and the deal closed as planned. The two insiders knew they could at least get their money back without penalty. It would be against the law for them to convert their equity into Newco without proper disclosure.

To be precise, the CLO spent $440,953 on 3-8-24 to return $884 today. Twelve days is probably not a bad return, exactly 6.18% annualized. There is no person on earth who would do that.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,