As the votes came in and the outcome of the Presidential election became clear, investors voted with their dollars. The market ripped 7.25% which was the largest election week rally in history. Not even our insiders could compete with the raw animal spirits unleased by the belief that a Democratic President would be restrained by a Republican Senate. Gridlock, strangely enough, is celebrated. There is another narrative-perhaps it was a relief rally that the most disruptive and unpredictable President in a lifetime was gone?

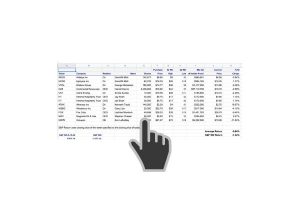

Sprouts Farmers Market Inc. up 9.84%

CHARLES RIVER LABORATORIES INTERNATIONAL Inc up 7.49%

Del Taco Restaurants Inc. up 7.29%

GOLUB CAPITAL BDC Inc. up 6.80%

ARES CAPITAL CORP up 6.31%

INTERNATIONAL BUSINESS MACHINES CORP up 0.99%

Inovalon Holdings Inc. up 0.72%

Clough Global Equity Fund up 0.60%

GREENHILL & CO INC up 0.00%

American National Group Inc down -.1.17%

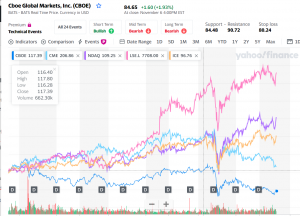

Cboe Global Markets Inc. down -1.17% and -5.33%

Director Fortunato bought 13,300 shares of Sprouts Farmers Market at $18.80. SFM Sprouts Farmers Market, Inc., is a supermarket chain headquartered in Phoenix, Arizona, US. The grocer offers a wide selection of natural and organic foods, including fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, deli, baked goods, dairy products, frozen foods, natural body care and household items.

Sprouts made a huge rally off the March lows only to roll over in the middle of July. It’s likely that that the two new insider buys will arrest the slide. Was the share price loss warranted? It’s hard to see how any grocer can be hurting as the pandemic has changed people’s dining habits, preferring to eat at home than exposing themselves to the virus at restaurants.

Sprouts reported a strong quarter on October 28th, blowing past consensus $.52 versus $.26. The Company did say “As customers continue to consume much of their food at home due to the COVID-19 pandemic, grocery spend and ecommerce penetration have remained at elevated levels, as do additional company expenses.”

I personally like Sprouts but it’s hard to compete with Amazon’s Whole Foods and its unrivaled financial ability to gain market share. Sprout’s footprint is smaller than a typical Whole Food store. It may make a nice bite sized acquisition for a national footprint grocer wanting to ride the natural foods enthusiasm of millennial and gen Z shoppers.

We jumped all over Charles River Labs and rode CRL’s healthy 7.49% gain. Director Wallman bought 7,200 shares at $233.20. This is a case of insider buying at near market tops. This signals that business is good and its going to get better. Perhaps it was to purchase back the shares he sold in February at $172. It’s clear that business is good but several insiders took advantage of a record high price to lighten up, including the CEO and Chairman’s sale of 22,000 shares at $232.38, VP sale of 6,739 shares, and another’s sale of 2150 shares at $236.29. When there are buyers and sellers of the same security, its difficult to interpret the signals. In this case we just took the money and ran. That’s the great thing about trading with insiders. They are subject to the short swing rule. You, the general public, are not. For more about the short swing rule, see our webinar The Insiders Guide to Making Money in the Market.

Charles River Laboratories, Inc., is an American corporation specializing in a variety of preclinical and clinical laboratory services for the pharmaceutical, medical device and biotechnology industries.

Director Levi continues to buy Del Taco Restaurants. This time he bought 62,881 shares of TACO at $7.46. Del Taco Restaurants Inc. is an American fast food restaurant chain which specializes in American-style Mexican cuisine as well as American foods such as burgers, fries, and shakes. How can you not like a stock market ticker like TACO? We’d buy a buyer on small dips as the upside seems limited.

Golub Capital and ARES Capital insiders continue to buy these mid market lenders. Golub management bought $780K worth at $12.64 while ARES management, included CEO deVeer buying 75,000 shares of ARCC at $13.98. GBDC yields 8.59% and ARCC yields 10.92%. Both of these companies pay out large dividends and are good ideas for income seeking investors although neither company have offered any price appreciation. Perhaps that is changing.

Yet another insider at IBM buys the fallen computer giant. Director Liveris purchased 2,655 shares at $112.92. This continues the buying we highlighted last week. Cluster buying is important and it’s also revealing that these are the first insider buys in two years and it took prices to sink to 2018 levels to engender it. We like the outsized dividend at 5.72% but the growth prospects are limited.

Inovalon Holding insiders bought shares in the medical informatics company, INOV. Director Teuber bought 10,000 at $19.48 and CAO DeBock bought 15,000 shares at $19.03, and CEO Dunleavy purchased 60,000 shares at $19.62.

THIS IS WHAT the Company is about from the web site:

Inovalon is a leading provider of cloud-based platforms empowering data-driven healthcare. Through the Inovalon ONE® Platform, Inovalon brings to the marketplace a national-scale capability to interconnect with the healthcare ecosystem, aggregate and analyze data in real time, and empower the application of resulting insights to drive meaningful impact at the point of care. Leveraging its Platform, unparalleled proprietary datasets, and industry-leading subject matter expertise, Inovalon enables better care, efficiency, and financial performance across the healthcare ecosystem. From health plans and provider organizations, to pharmaceutical, medical device, and diagnostics companies, Inovalon’s unique achievement of value is delivered through the effective progression of “Turning Data into Insight, and Insight into Action®.” Supporting thousands of clients, including 24 of the top 25 U.S. health plans, 22 of the top 25 global pharma companies, 19 of the top 25 U.S. healthcare provider systems, and many of the leading pharmacy organizations, device manufacturers, and other healthcare industry constituents, Inovalon’s technology platforms and analytics are informed by data pertaining to more than one million physicians, 565,000 clinical facilities, 324 million Americans, and 58 billion medical events.

Sounds great, right? We are small buyers of INOV. We wish we could be aggressive buyers but INOV is barely profitable and highly indebted, 3.5X coverage . INOV has grown through a series of acquisitions that they have paid for with a combination of stock, cash, and debt. Although never a very profitable business, INOV is where the hockey puck is going. Information processing about health matters is only going to rise in demand. During the last quarter, INOV posted strong quarterly growth. Some of the the highlights:

- Q3 revenue of $161.4 million

- Q3 subscription-based platform revenue of $142.5 million, up 1% YoY, equating to 88% of Q3 total revenue

- Q3 net income of $0.8 million, resulting in diluted net income of $0.01 per share

- Q3 Non-GAAP net income of $23.7 million, up 8% YoY, resulting in Non-GAAP net income of $0.16 per share

- Q3 Adjusted EBITDA of $58.8 million, resulting in Adjusted EBITDA margin of 36.4%

- Q3 net cash provided by operating activities of $46.0 million, up 42% YoY

- Net debt leverage ratio as of September 30, 2020 improved to 3.55x (versus 4.23x on September 30, 2019)

Last but certainly not the least, CBOE Global Market transactions. This is the name we put the most money to work with. Ironically it was the worst performing insider buy of the week but we picked up shares for a little below what the insiders were paying. CEO and Chairman of the Board Tilly purchased 10,000 shares of CBOE at $89.42. Director Tomcyzk bought 5,230 shares at $85.65 These are the first open and only open market purchases at the Company. Tilly has been CEO since 2013.

Cboe Global Markets owns and operates four options exchanges seven equities , including the Cboe Options Exchange, one futures exchange: Cboe Futures Exchange; and one foreign exchange marketplace. Cboe’s top 7 competitors are CME Group, Nasdaq, NYSE, Deutsche Borse, Euronext, London Stock Exchange and ASX. ,

The Nasdaq and CME are publicly traded in the U.S.. The London Stock Exchange and Deutche Borse tried to merge but was blocked by the EU on anti trust concerns about monopolies. The New York Stock Exchange was acquired by Intercontinental Exchange of Atlanta for$8. 2 billion in 2012.

As you can see in the chart below linked back to Yahoo finance, the CBOE is far and away the worst performing of the publicly traded exchanges. Why is that you have to ask yourself? CBOE reported Q3 adjusted EPS $1.11 down 14% versus the prior year. Revenue for the quarter was down 1 percent. The Company paid cash dividends of $0.42 per share. At Friday’s closing price of $84.56, that’s an annual yield of 2%. The company had cash on hand of $213.2 and debt of $939.1 million. Our back of the envelope DCF value is close to twice the current price. CBOE is substantially undervalued, even with little or no growth. The challenge though to higher valuations is that all these exchanges are already under regulator scrutiny and any buyers would likely have to be non exchanges to avoid antitrust concerns.

| Cboe Global Markets reports Q3 adjusted EPS $1.11, consensus $1.06 | |||

| Reports Q3 revenue $292M, consensus $285.61M. | |||