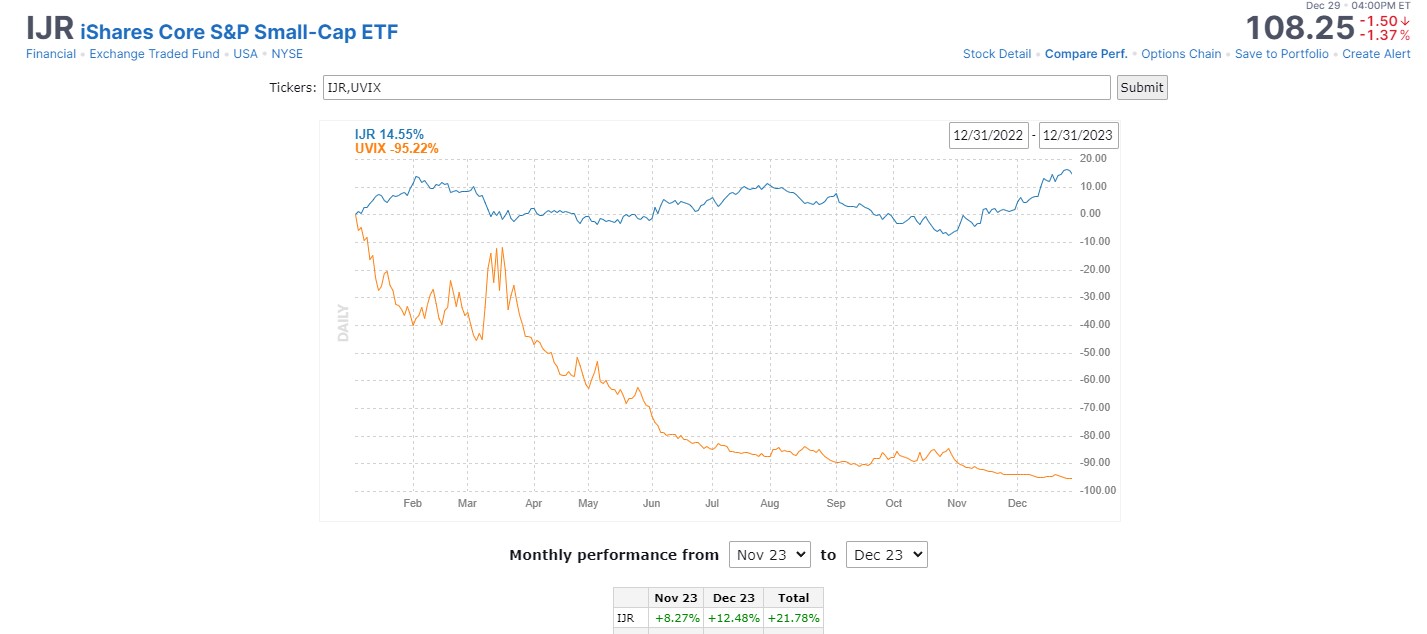

Here we go again, two insider buys in small biotech names that rocketed 43% and 76% last week. This didn’t happen in a vacuum. For the last two months or so, the daily top 50 largest percentage gainers and losers are filled with small-cap and bulletin board names you’ve never heard of, ripping up and down 40%-150% in a shark-like blood-infested feeding frenzy. The list is composed mostly of obscure biotech stocks, pre-revenue or little revenue shells, SPACS, and cryptocurrency names, scams, and fantasies inspired by occasional real biotech transactions, the most notable being the 273% premium Sanofi paid for Prevention Bio. One look at the pin action in the small-cap index in the last two months should convince you the market has just entered Class 4 rapids. The IJR S&P Small Cap ETF is up 21.78% from November through December, while the SPY, S&P 500 ETF is only up 13.66%. Meanwhile, volatility has plummeted. UVIX, a 2x Volatility long ETF, has plummeted 58.41%. We have the ingredients for a combustible event. As usual, timing is everything.

Last week, we utilized Bing’s Chat GPT 4 LLM as a basis for some of our research. This week, we switched to Bard’s LLM. We included our prompts so you could see how we were tweaking the models. Watch out for hallucinations and our regular disclaimer at the end of every post. Be sure not to miss this report. You can be an insider, too– by clicking here.

Name: T Scott Martin

Position: Director

Transaction Date: 2023-12-21 Shares Bought: 30,000 Average Price Paid: $15.36 Cost: $460,855

Company: Kimbell Royalty Partners LP (KRP)

Kimbell Royalty Partners, LP, and its subsidiaries acquire and hold mineral and royalty interests in oil and gas properties in the United States. The corporation acts as the general partner. Kimbell Royalty Partners, LP, based in Fort Worth, Texas, was founded in 2015. They provide fair appraisals for high-quality assets, ensuring that both parties benefit. By keeping their word and establishing long-term partnerships, they’ve developed a reputation for honesty and transparency in the industry.

T. Scott Martin was appointed to the board of directors of our general partner, Kimbell Royalty GP, LLC, in November 2015. He has been the Chief Executive Officer and Chairman of our predecessor, Rivercrest Royalties, LLC, since July 2014 and the Chief Executive Officer and Chairman of EE3 LLC since 2011. Mr. Martin started Ellora Energy LLC in 1995 and served in various management positions until 2010. Previously, he worked as a senior executive for Alta Energy Corporation, TPEX Exploration, Inc., and as a consultant engineer for BWAB, Inc. He began his career in 1979 at Amoco Production Company. Mr. Martin has a BA in Biology from Colorado College and a BS in Chemical Engineering from the University of Colorado at Boulder. He is a member of the Society of Petroleum Engineers and a member of the Independent Petroleum Association of America.

Opinion: https://g.co/bard/share/583aef17ccf1

Kimbell Royalty Partners LP (KRP): Dividend History and Current Yield

Kimbell Royalty Partners LP (KRP) is a midstream energy company holding mineral and royalty interests in oil and gas producing properties across the United States. They own acreage in some of the country’s most active basins, generating revenue through royalty payments based on production levels.

Dividend History:

- Consistent Payout: KRP has a strong track record of paying consistent quarterly dividends. Since its inception in 2017, the company has never missed a dividend payment.

- Recent Increases: Notably, KRP has increased its dividend payout several times in recent years. The most recent increase was in November 2023, when the quarterly dividend was raised from $0.51 to $0.54 per share.

- Historical Data: Different sources provide slightly different historical dividend details, but here’s a summary:

- Macrotrends: Provides data from 2019 onwards, showing a current TTM (trailing twelve months) dividend payout of $2.04 per share and a current yield of 13.38% as of December 22, 2023. https://www.macrotrends.net/stocks/charts/KRP/kimbell-royalty/dividend-yield-history

- Dividend.com: Shows a current annualized dividend of $1.72 and a yield of 10.9%, though notes that ex-dividend date and next payment details are unavailable. https://www.nasdaq.com/market-activity/stocks/krp/dividend-history

- StreetInsider: Offers a list of historical quarterly dividends going back to 2018, with the most recent dividend of $0.51 paid on November 20, 2023. https://www.nasdaq.com/market-activity/stocks/krp/dividend-history

Current Yield:

- High Yield: Based on the information above, KRP’s current annualized yield is estimated to be between 10.9% and 13.38%, significantly higher than the average yield of the S&P 500 index (around 1.8%).

- Attractive to Income Investors: This high yield makes KRP an attractive option for income investors seeking consistent cash flow from their investments.

Sources:

- Kimbell Royalty Partners website: https://kimbellrp.com/

- Macrotrends: https://www.macrotrends.net/stocks/charts/KRP/kimbell-royalty/dividend-yield-history

- Dividend.com: https://www.nasdaq.com/market-activity/stocks/krp/dividend-history

- StreetInsider: https://www.nasdaq.com/market-activity/stocks/krp/dividend-history

Name: Jack Hightower

Position: Chief Executive Officer & 10% Owner

Transaction Date: 2023-12-21 Shares Bought: 150,442 Average Price Paid: $14.38 Cost: $2,162,826

Company: HighPeak Energy Inc. (HPK)

HighPeak Energy, a Delaware corporation founded on October 29, 2019, is an independent crude oil and natural gas business focused on acquiring, developing, and producing crude oil, natural gas liquids (NGLs), and natural gas deposits. The Company has two large continuous land positions, one in the north, known as the Flat Top region, and one in the south, known as the Signal Peak area. HighPeak Energy concentrates its efforts in the Midland Basin, notably in Howard and Borden Counties. The Howard and Borden Counties area of the Midland Basin has been partially developed with vertical wells using conventional methods over the last eight decades and has recently experienced significant redevelopment activity in the Lower Spraberry and Wolfcamp A formations utilizing modern horizontal drilling technology, with some operators having additional success developing the Middle Spraberry, Jo Mill, Wolfcamp B, and Wolfcamp D formations through the use of modern, high-tech horizontal drilling technology.

Mr Hightower has over 49 years of experience operating several E&P platforms in the oil and gas business. From 2011 until 2013, Mr. Hightower was Bluestem Energy Partners, LP’s Chairman, President, and CEO. Mr. Hightower served as Chairman, President, and CEO of Celero Energy II, LP from 2006 to 2009 and as Chairman, President, and CEO of Celero Energy, LP from 2004 to 2005 before founding Bluestem. Mr. Hightower formerly served as Chairman, President, and CEO of Pure Resources, Inc., which grew to become the 11th biggest publicly traded independent E&P business in North America. Unocal tendered for the Pure Resources shares it did not own in October 2002. Mr. Hightower launched Titan, the forerunner to Pure Resources, in March 1995 and served as Chairman, President, and CEO. Mr. Hightower earned a Bachelor of Business Administration degree in Administrative Finance and Money, Banking, and Investments from Texas Tech University in 1970.

Opinion: https://g.co/bard/share/c9d1d7bf9d43

HighPeak Energy Inc. (HPK): CEO Jack Hightower’s Share Purchase Explained

HighPeak Energy’s CEO, Jack Hightower, recently purchased 150,442 shares of the company’s stock at $14.38 per share, bringing his total ownership to roughly 10%. This significant purchase has naturally sparked interest and speculation. Here’s a breakdown of some relevant factors that might explain Hightower’s decision:

Recent HighPeak Developments:

- Strong Q3 2023 Earnings: HighPeak delivered strong financial results in Q3, exceeding analyst expectations for both revenue and production. This included a 77% year-over-year increase in production and a 126% increase in net income.

- Debt Reduction: The company achieved significant debt reduction during the quarter, further strengthening its financial position.

- Positive Analyst Coverage: Several analysts have maintained positive outlooks on HighPeak, citing its strong operational performance and attractive valuation.

Potential Motivations for Hightower’s Purchase:

- Confidence in the Company: Hightower’s personal investment could be seen as a vote of confidence in HighPeak’s future prospects. The recent positive news and financial performance might indicate his belief in the company’s continued growth and value creation.

- Skin in the Game: By increasing his ownership stake, Hightower aligns his personal financial interests with those of shareholders. This can be seen as a commitment to driving long-term value for the company and its investors.

- Market Opportunity: Some analysts speculate Hightower might see an undervalued opportunity in HPK’s current stock price. The recent purchase could be strategic, aiming to capitalize on potential future stock price appreciation.

Additional Information:

- Insider Transactions: It’s important to consider other recent insider transactions at HighPeak. While Hightower’s purchase is significant, any additional buying or selling from other company executives could provide further insights into their sentiment.

- Macroeconomic Factors: The broader oil and gas sector, as well as general market conditions, could also influence Hightower’s decision. Ongoing global energy concerns and potential economic shifts might be additional factors he considered.

Name: Yekaterina Chudnovsky GKCC LLC

Position: Director & 10% Owner

Transaction Date: 2023-12-22 Shares Bought: 1,213,000 Average Price Paid: $5.81 Cost: $7,047,530

Company: Elicio Therapeutics Inc. (ELTX)

Elicio Medicines Inc. is a clinical-stage biopharmaceutical business focused on discovering, developing, and commercializing innovative small-molecule medicines to target chronic and progressive fibrotic disorders before our 2022 Strategic Realignment. The company goal was to change the therapeutic paradigm for patients suffering from potentially life-threatening illnesses for whom no approved drugs exist or when existing approved treatments have known limits. The product candidates and programs included ANG-3070, a highly selective oral tyrosine kinase receptor inhibitor in development as a treatment for fibrotic diseases, a ROCK2 preclinical program for the treatment of fibrotic diseases, a CYP11B2 preclinical program for diseases related to aldosterone synthase dysregulation, and a CYP26 inhibitor program for a variety of indications, including cancer, and ANG-3777, If the merger with Elicio Therapeutices, Inc. is not completed, they anticipate to continue developing ANG-3070 and undertaking additional preclinical investigations for the ROCK2 program.

Yekaterina Chudnovsky presently serves as General Counsel for a national privately held technology corporation, where she is in charge of intellectual property, trademarks, technology acquisition, and mergers and acquisitions. She has also served as a Board Member of the GI Research Foundation (GIRF) at the University of Chicago Digestive Diseases Centre for the past ten years and was chosen President of the Board in 2019. Before her present positions, she worked at Thomas Coburn Fagel Haber, where she specialized in corporate law, real estate, mergers and acquisitions, bankruptcy, and commercial banking. Mrs. Chudnovsky graduated from Northwestern University with a B.A. in political science and Slavic literature and a J.D. from DePaul University.

Opinion: https://g.co/bard/share/2db5b7e6d56e

Elicio Therapeutics Inc. (ELTX): Recent News and Developments

Elicio Therapeutics is a clinical-stage biotechnology company developing innovative immunotherapies for cancer, primarily focused on aggressive tumors like pancreatic and colorectal cancers. Here’s a summary of recent news and events that might be relevant to Yekaterina Chudnovsky’s significant share purchase:

Positive Phase 1a Data:

- ELI-002 2P vaccine: In November 2023, Elicio presented promising data from the AMPLIFY-201 Phase 1a study of ELI-002 2P. The vaccine induced T cell responses targeting mKRAS, a key driver of pancreatic and colorectal cancers. Patients experienced a median relapse-free survival of 16.3 months, suggesting potential efficacy.

- ELI-007 and ELI-008: Preclinical data presented at the SITC 2023 meeting showed these next-generation candidates have the potential to activate both CD4+ and CD8+ T cells, potentially leading to broader anti-tumor immunity.

Recent Events:

- Subscription Agreement: Elicio announced a $40 million subscription agreement with institutional investors in December 2023. This bolsters their financial position and supports ongoing clinical development.

- Analyst Coverage: Several analysts have initiated coverage of Elicio recently, providing mixed outlooks but generally acknowledging the potential of their pipeline and recent data.

Chudnovsky’s Share Purchase:

Yekaterina Chudnovsky’s significant purchase of ELTX shares could be interpreted in several ways:

- Confidence in Elicio’s Technology and Pipeline: The timing of the purchase coincides with recent positive data and financing news, suggesting Chudnovsky might be optimistic about the company’s future prospects.

- Long-Term Investment: Chudnovsky previously held indirect shares in Elicio, indicating a potential long-term interest in the company.

- General Biotech Optimism: The wider biotech sector has seen some positive momentum recently, which could also influence investment decisions.

Disclaimer:

It’s important to note that Chudnovsky’s motives for purchasing shares are unknown, and this information should not be considered financial advice. Thoroughly research and consult with a financial advisor before making any investment decisions.

Additional Resources:

- Elicio Therapeutics website: https://elicio.com/

- Elicio Therapeutics press releases: https://elicio.com/news/company-news/

- Nasdaq ELTX stock page: https://www.nasdaq.com/market-activity/stocks/eltx

I hope this information is helpful! Let me know if you have any other questions about Elicio Therapeutics or related topics.

Name: Srinivas Akkaraju

Position: Director

Transaction Date: 2023-12-21 Shares Bought: 904,977 Average Price Paid: $4.42 Cost: $3,999,998

Company: Syros Pharmaceuticals Inc. (SYRS)

Syros Pharmaceuticals Inc. is a biopharmaceutical firm dedicated to creating new standards of care for patients with hematologic malignancies. It is motivated by a desire to assist patients suffering from blood diseases that have mostly eluded existing focused methods. In addition, in the Phase 1 clinical trial, we are testing SY-5609, a highly selective and powerful oral inhibitor of cyclin-dependent kinase 7, or CDK7, as a sole agent in patients with select solid tumors and in conjunction with gemcitabine, chemotherapy in pancreatic cancer patients. In addition, SY-5609 is being tested in combination with atezolizumab, a PD-L1 inhibitor, in BRAF-mutant colorectal cancer in a Phase 1/1b clinical trial sponsored by F. Hoffmann-La Roche AG, or Roche, which is currently recruiting patients. We also have many preclinical and discovery programs in oncology, including SY-12882, our oral CDK12 inhibitor, as well as programs targeting CDK11 and WRN inhibition.

Srinivas Akkaraju, M.D., Ph.D., has approximately 20 years of investment and operating expertise in the life sciences sector. Dr. Akkaraju is the Founder and Managing General Partner of Samsara BioCapital. Before founding Samsara BioCapital, he worked as a General Partner at Sofinnova Ventures from April 2013 to June 2016, Managing Director at New Leaf Venture Partners from January 2009 to April 2013, and Managing Director at Panorama Capital, a private equity firm he helped found, from September 2006 to December 2008. Dr. Akkaraju is now the chairman of the board of Versartis and a director of Intercept Pharmaceuticals, Seattle Genetics, and aTyr Pharma. He formerly served on the boards of Barrier Therapeutics, Eyetech Pharmaceuticals, ZS Pharma, Synageva Biopharma Corp., and Amarin Corp. Dr. Akkaraju earned an M.D. and a Ph.D. in Immunology from Stanford University, as well as undergraduate degrees in Biochemistry and Computer Science from Rice University.

Opinion: https://g.co/bard/share/75e4ffbf0c41

Overview:

- Syros is a clinical-stage biopharmaceutical company developing medicines that control gene expression to treat diseases, with a focus on hematologic malignancies (blood cancers).

Syros Pharmaceuticals logo

- Their lead candidate, tamibarotene, is an oral selective retinoic acid receptor alpha (RARα) agonist undergoing late-stage clinical trials for the treatment of myelodysplastic syndrome (MDS) and acute myeloid leukemia (AML) with RARA gene overexpression.

- The company is also developing other early-stage candidates for various hematologic malignancies and solid tumors.

Recent Developments:

- Positive Phase 2 Data for Tamibarotene: In December 2023, Syros announced encouraging initial data from the SELECT-AML-1 Phase 2 clinical trial evaluating tamibarotene in combination with venetoclax and azacitidine for the treatment of newly diagnosed AML with RARA gene overexpression. The data showed promising overall survival and minimal residual disease rates.

Phase 2 Clinical Trial for Tamibarotene

- Financing: In December 2023, Syros raised $45 million through an underwritten offering of common stock and pre-funded warrants. This will support their ongoing clinical development activities.

- Analyst Coverage: Several analysts have initiated coverage of Syros recently, with mixed outlooks but generally acknowledging the potential of their pipeline and recent data.

Potential Investment Considerations:

- Promising Pipeline: Tamibarotene has the potential to be a first-in-class treatment for RARA-overexpressing MDS and AML, a market with significant unmet medical need.

- Experienced Management Team: Syros has a team of experienced executives with a track record of success in the pharmaceutical industry.

- Risks: Clinical development is inherently risky, and there is no guarantee that tamibarotene or any other Syros candidate will be approved for commercialization.

Overall, Syros is an intriguing biopharmaceutical company with a promising pipeline and a focus on addressing unmet medical needs in hematologic malignancies. However, as with any investment, it is important to carefully consider the risks and potential rewards before making any investment decisions.

Additional Resources:

- Syros Pharmaceuticals website: https://www.linkedin.com/company/syros-pharmaceuticals

- Syros Pharmaceuticals press releases: https://ir.syros.com/

- Nasdaq SYRS stock page: https://finance.yahoo.com/quote/SYRS/

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,