An arms race is just beginning, but it’s not the traditional weapons of war. Artificial intelligence is the most disruptive technology to come along since the Internet. Large language models like Open AI’s ChatGPT are the machine learning equivalent of the Internet browser. The full-fledged arms race is underway.

Name: Brent Windom

Position: Director

Transaction Date: 2024-03-19 Shares Bought: 2,617 Average Price Paid: $83.00 Cost: $217,211

Transaction Date: 2024-03-15 Shares Bought: 2,683 Average Price Paid: $80.57 Cost: $216,173

Company: Advance Auto Parts Inc (AAP)

Advanced Auto Parts, Inc. was formed in 1929 and is headquartered in Raleigh, North Carolina. Advance Auto Parts, Inc. sells automotive replacement parts, accessories, batteries, and maintenance supplies for domestic and imported automobiles, vans, sport utility vehicles, and light and heavy-duty trucks. The company sells battery accessories, belts and hoses, brakes and brake pads, chassis, and climate control parts, clutches and drive shafts, engines and engine parts, exhaust systems and parts, hub assemblies, ignition components and wires, radiators and cooling parts, starters and alternators, and steering and alignment parts. Additionally, it provides battery and wiper installation, engine light scanning and checking, electrical system testing (including batteries, starters, and alternators), oil and battery recycling, and loaner tool program services. Additionally, the company offers its products on its website. The corporation operates stores in the United States, Puerto Rico, the United States Virgin Islands, and Canada, as well as independently operated Carquest-branded stores in Mexico and numerous Caribbean islands.

Mr. Windom became a member of the Board in March 2024. Mr. Windom has been the president of Windom Consulting LLC, which offered strategic consulting services to Uni-Select, Inc. Before founding Windom Consulting, Mr. Windom served as President and CEO of Uni-Select until his retirement in 2021. Mr. Windom was President and Chief Operating Officer of Canadian Automotive Group from 2017 to 2019, during which time he oversaw the company’s strategic assessment and turnaround. Before 2017, Mr. Windom was the CEO of Icahn Automotive Group LLC and the COO of Uni-Select USA.

Opinion: I’m not sure why Mr.Windom is buying AAP, but it’s working for him at the moment.

Name: Che-Wei Lin

Position: Director

Transaction Date: 2024-03-18 Shares Bought: 31,370 Average Price Paid: $12.70 Cost: $398,283

Company: Applied Optoelectronics Inc. (AAOI)

Applied Optoelectronics, Inc. was established in 1997 and is based in Sugar Land, Texas. Applied Optoelectronics, Inc. is a prominent, vertically integrated provider of fiber-optic networking equipment, with a focus on four networking end markets: internet data centers, cable television, telecommunications, and fiber-to-the-home. The company designs and produces optical communications solutions at a variety of integration levels, from components, subassemblies, and modules to entire turnkey systems. The company designs and manufactures a wide range of goods based on these foundational items to fulfill the client’s needs and specifications, and these products differ in terms of end market, intended use, and level of integration. The customers in this market are typically big internet-based data center operators, as well as equipment suppliers who provide their products and others to the hyperscale data center operator customers.

Che-Wei Lin joined the Board in January 2014, having previously served from December 2006 to October 2009. Since November 2007, Mr. Lin has been the President of ASMedia Technology Inc., a chipset maker. Mr. Lin has also been the Corporate Vice President of ASUSTek Computer Inc.’s Motherboard Business Unit, which is part of the Open Platform Business Group, since November 2009. From 1993 to 2007, Mr. Lin worked at VIA Technologies, Inc., a manufacturer of integrated circuits and motherboard chipsets, in a variety of roles, including President of the Desktop Platform Business Unit, Vice President of the System Platform Division, and Vice President of OEM and Chipset Product Marketing. Mr. Lin earned a BS in Electrical Engineering from Fu Jen University in Taiwan and an MS in Electrical Engineering from the University of Missouri.

Opinion: The semiconductor industry is undergoing major cyclical changes due to AI’s breakthrough large language models. I asked Microsoft copilot this prompt:” How does fiberoptics fit into recent AI breakthroughs around large language models and NVidia’s GPU and accelerated computing?”

Copilot:

Fiber optics play a crucial role in supporting the infrastructure required for AI breakthroughs, especially those involving large language models (LLMs) and advanced computing platforms like NVIDIA’s GPUs. The high-speed data transmission capabilities of fiber optics are essential for handling the massive amounts of data processed by LLMs and for connecting distributed computing resources efficiently.

NVIDIA’s recent advancements, such as the Blackwell platform, have significantly reduced the cost and energy consumption of running real-time generative AI on trillion-parameter LLMs1. This platform, along with the H100 NVL GPU featuring a Transformer Engine, is designed to process models like GPT, which powers ChatGPT2. These technologies rely on robust data centers and network infrastructure, where fiber optics provide the necessary bandwidth and speed.

Moreover, NVIDIA’s collaboration with cloud providers and the development of technologies like Project Ceiba—which combines NVIDIA’s next-generation Grace Blackwell Superchips with advanced virtualization and ultra-fast networking—highlight the importance of fiber optics in enabling these AI and computing innovations1.

In summary, fiber optics underpin the communication and data transfer backbone that allows AI research and development to flourish, supporting the deployment and scaling of LLMs and accelerated computing solutions.

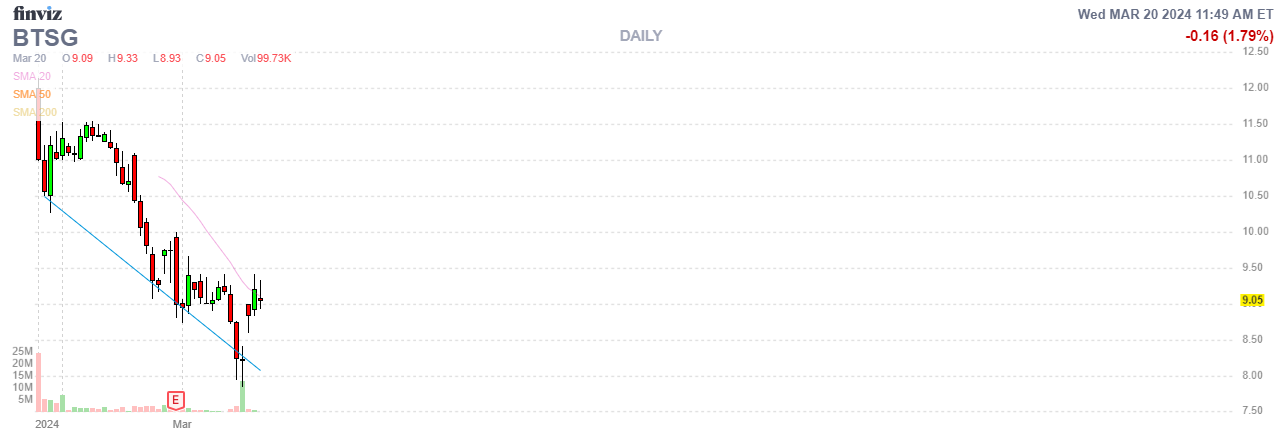

Name: James F Jr Mattingly

Position: Executive Vice President & CFO

Transaction Date: 2024-03-14 Shares Bought: 12,280 Average Price Paid: $8.18 Cost: $100,450

Company: BrightSpring Health Services Inc. (BTSG)

Name: Jennifer A Phipps

Position: Chief Accounting Officer

Transaction Date: 2024-03-14 Shares Bought: 12,300 Average Price Paid: $8.14 Cost: $100,122

Company: BrightSpring Health Services Inc. (BTSG)

Name: Jon B Rousseau

Position: President & Chief Executive Officer

Transaction Date: 2024-03-14 Shares Bought: 37,405 Average Price Paid: $8.12 Cost: $303,729

Company: BrightSpring Health Services Inc. (BTSG)

BrightSpring Health Services, Inc., founded in 1974, is headquartered in Louisville, Kentucky. The company was formerly known as Phoenix Parent Holdings Inc. before changing its name to BrightSpring Health Services, Inc. in May 2021. They are a prominent home and community-based healthcare services platform that specializes in offering comprehensive pharmacy and provider services to complex patients. The organization takes a novel approach to care delivery, employing an integrated and scalable architecture to address critical services that the most needy and expensive patients demand. Their platform, which focuses on Senior and Specialty patients, including Behavioural groups, provides low-cost pharmacy and provider services in home and community settings to Medicare, Medicaid, and commercially insured patients. The company’s technique is based on offering high-touch and coordinated services to medically demanding clients and patients, a big, growing, and underserved demographic in the US healthcare system.

Jim Mattingly has been the Executive Vice President and CFO since October 2017. Mr. Mattingly was senior vice president and chief financial officer of Kindred Rehabilitation Services from April to October 2017, before joining the company. Mr. Mattingly previously served as vice president and chief financial officer at Kindred Rehabilitation Services from October 2015 to April 2017, as well as vice president of finance and controller for Kindred at Home and several senior financial positions at Fortune Brands and Yum! Mr. Mattingly earned a Bachelor of Arts in economics and philosophy from Bellarmine University and a Master of Business Administration from Indiana University Bloomington.

Jennifer Phipps currently serves as the Chief Accounting Officer for BrightSpring Health Services, Inc. Jen Phipps, Chief Accounting Officer, was named to Leadership Louisville’s Elevate: A Women’s Leadership Council. The council is made up of Louisville’s finest female leaders who will counsel and support the Alice Houston Women’s Leadership Program participants.

Jon Rousseau has been the President and CEO and a member of the board of directors since September 2016. Mr. Rousseau was an executive vice president at Kindred Healthcare, Inc. from June 2013 to July 2016, where he held several leadership positions, including president of Kindred Rehabilitation Services and, before that, president of the Care Management Division and Kindred at Home, Kindred’s home health, hospice, home care, and home-based primary care businesses. Before Kindred, Mr. Rousseau held several senior leadership positions at other market-leading healthcare product and technology companies, including vice president of global marketing, strategy, and commercial development at Mylan, Inc. and global senior director of the continuous glucose monitoring franchise at Medtronic PLC (2006-2013). He earned his MBA from Harvard Business School and his A.B. from Princeton University.

Opinion: A Deutsche Bank analyst recently called the company a “diverse and complex business,” which has weighed on shares out of the gate given the limited understanding of the multiple business lines and visibility into historical performance. A raft of insider buying last week sure made it sound simpler, propelling the stock 18% higher

Name: Nicolas Finazzo

Position: Chairman & CEO

Transaction Date: 2024-03-12 Shares Bought: 35,800 Average Price Paid: $6.88 Cost: $246,220

Company: AerSale Corp (ASLE)

AerSale Corporation was founded in 2008, with its headquarters in Coral Gables, Florida. The company supplies aftermarket commercial aircraft, engines, and components to passenger and cargo airlines, leasing companies, original equipment manufacturers, government and defense contractors, and maintenance, repair, and overhaul service providers worldwide. It operates in two segments: Asset Management Solutions and Technical Operations. The Asset Management Solutions segment sells, rents, and disassembles aircraft, engines, and airframes for parts. The TechOps sector provides both internal and third-party aviation services, including internally developed designed solutions, heavy aircraft repair and modification, component MRO, and end-of-life disassembly services.

Nicolas Finazzo has almost 30 years of experience in aircraft leasing, financing, maintenance, and airline operations. Nicolas established a commercial aircraft leasing company early in his career, which ultimately evolved into Air Florida Commuter, a regional airline. He joined International Air Leases as Vice President in 1992 and was promoted to Corporate General Counsel in 1994, overseeing a 200-strong commercial aircraft fleet. In 1997, he cofounded and became CEO of AeroTurbine, Inc., the first non-OEM aftermarket firm to combine aircraft and engine sales, leasing, parts sales, and aviation maintenance and repair into one platform. After selling AeroTurbine in 2006, he and business partner Bob Nichols established AerSale® in 2008. Nicolas earned his Juris Doctorate from the University of Miami School of Law and a Bachelor of Science in Political Science from the University of Michigan.

Opinion: Used aircraft parts is not a sexy business and one that will struggle for investor mindshare, even with some healthy insider buying.

Name: Stellantis N.V. / FCA US LLC / FCA North America Holdings LLC / FCA Foreign Sales Holdco LTD. / SFS UK 1 LTD.

Position: 10% Owner

Transaction Date: 2024-03-08 Shares Bought: 1,600,000 Average Price Paid: $4.71 Cost: $7,539,040

Company: Archer Aviation Inc. (ACHR)

Archer Aviation Inc. develops and manufactures electric vertical takeoff and landing aircraft for urban air mobility systems. The company’s mission is to open up the skies, allowing people to rethink how they travel and spend their time. Their eVTOL planes are designed to be safe, long-lasting, and quiet. Midnight’s production aircraft, which will be introduced in November 2022, is based on their unique 12-tilt-6 design. This means that it has 12 propellers attached to 6 booms on a fixed wing, with all 12 propellers providing vertical lift during takeoff and landing, and the forward six propellers tilting forward to cruise position to provide propulsion during forward flight, while the wing provides aerodynamic lift like a conventional airplane. Midnight is designed to carry four passengers and a pilot for up to 100 miles at speeds of up to 150 mph, but it is best suited for back-to-back short-distance excursions of around 20 miles, with a charging time of about 10 minutes between trips.

Stellantis is a group of 14 historic vehicle firms and two mobility arms dedicated to more than just transportation: moving people and making connections. Stellantis will collaborate with Archer to establish the company’s previously announced production plant in Covington, Georgia, where the Midnight aircraft will be manufactured in 2024. Midnight’s 100-mile range makes it ideal for back-to-back short-distance excursions of about 20 miles, with a 10-minute charge time in between. This one-of-a-kind collaboration in urban air transportation will leverage each company’s assets and competencies to bring the Midnight aircraft to market. Archer will provide a world-class team of eVTOL, electric powertrain, and certification experts to the cooperation, while Stellantis will bring innovative manufacturing technologies and expertise, experienced personnel, and financial resources.

FCA US LLC (FCA US), formerly Chrysler Group LLC, designs, engineers, manufactures, distributes, and sells vehicles. The company sells passenger cars, minivans, sport utility vehicles, pickup trucks, and commercial vehicles under the names Dodge, Jeep, Fiat, Mopar, Lancia, Chrysler, Ram, Abarth, and Alfa Romeo. In addition, the firm provides retail and dealer finance, leasing, rental, and aftermarket services. It primarily sells its products in North America, specifically the United States, Canada, Mexico, and the Caribbean Islands. The company is a subsidiary of Fiat Chrysler Automobiles NV. FCA US is based in Auburn Hills, Michigan, USA.

FCA NORTH AMERICA HOLDINGS LLC is an active company in the United States of America. It is distinguished by its legal entity identifier (LEI). The LEI is a unique code used to identify legal organizations involved in global financial transactions. FCA NORTH AMERICA HOLDINGS LLC is classified as general and uses the legal form code HZEH. The legal address of the entity is C/O THE CORPORATION TRUST COMPANY, 19801 WILMINGTON, Delaware, US; however, the headquarters address is C/O THE CORPORATION COMPANY, 48178 SOUTH LYON, Delaware, US. The firm was established on May 13, 2009, and was first registered with an LEI on August 10, 2017, which is still in effect and was last updated on June 1, 2023.

FCA NORTH AMERICA HOLDINGS LLC is an active company in the United States of America. It is distinguished by its legal entity identifier (LEI). The LEI is a unique code used to identify legal organizations involved in global financial transactions. FCA NORTH AMERICA HOLDINGS LLC is classified as general and uses the legal form code HZEH. The legal address of the entity is C/O THE CORPORATION TRUST COMPANY, 19801 WILMINGTON, Delaware, US; however, the headquarters address is C/O THE CORPORATION COMPANY, 48178 SOUTH LYON, Delaware, US. The company was established on May 13, 2009, and was first registered with an LEI on August 10, 2017, which is still in effect and was last updated on June 1, 2023.

SFS UK 1 Ltd is an active company that was founded on November 12, 2021, with its registered office in Coventry, West Midlands. SFS UK 1 Ltd has been open for two years. According to the most recent confirmation declaration, dated November 11, 2023, there are currently two active directors and one active secretary.

Opinion: Flying battery-powered helicopters will become ubiquitous. Whether this is a new disruptive technology that can earn shareholders vast sums of money is far from clear at this early stage.

Name: Jarrod M Patten

Position: Director

Transaction Date: 2024-03-15 Shares Bought: 100,000 Average Price Paid: $3.32 Cost: $332,220

Company: Core Scientific Inc. (CORZ)

Name: Todd A Becker

Position: Director

Transaction Date: 2024-03-15 Shares Bought: 130,000 Average Price Paid: $3.16 Cost: $410,163

Company: Core Scientific Inc. (CORZ)

Name: Yadin Rozov

Position: Director

Transaction Date: 2024-03-15 Shares Bought: 80,000 Average Price Paid: $3.07 Cost: $245,968

Company: Core Scientific Inc. (CORZ)

Name: Adam Taylor Sullivan

Position: Chief Executive Officer

Transaction Date: 2024-03-15 Shares Bought: 65,300 Average Price Paid: $3.06 Cost: $199,962

Company: Core Scientific Inc. (CORZ)

Name: Eric Stanton Weiss

Position: Director

Transaction Date: 2024-03-15 Shares Bought: 15,000 Average Price Paid: $3.03 Cost: $45,396

Company: Core Scientific Inc. (CORZ)

Core Scientific, Inc. was created in 2017 and is based in Dover, Delaware. Core Scientific, Inc. offers digital asset mining services in North America. It operates in two segments: mining and hosting. The company provides blockchain infrastructure, software solutions, and services, in addition to operating data center mining facilities. It also mines digital assets for its own account and offers hosting services to other large Bitcoin miners, including deployment, monitoring, troubleshooting, optimization, and maintenance of their digital asset mining equipment. In addition, the company provides electrical power, repair, and other infrastructure services for operating, maintaining, and earning digital assets, as well as selling mining equipment to consumers.

Mr. Patten developed and operates RRG, a global real estate advising firm, and has served as president and CEO since its creation in 1996. Mr. Patten’s professional career has been committed to the creation and implementation of real estate, technology, and technology management solutions that improve operational controls, reduce operating expenses, and provide long-term cost benefits to space users throughout the world. Mr. Patten’s leadership, foresight, and skill have been instrumental in delivering billions of dollars in value to a wide range of cutting-edge enterprises around the world. Mr. Patten has served on the board of directors of MicroStrategy Incorporated since November 2004. MicroStrategy is a multibillion-dollar public corporation based in Tysons Corner, Virginia, in the Washington metropolitan region. MicroStrategy has also established a significant digital assets business and is presently the largest public firm holding Bitcoin on its corporate balance sheet.

Mr. Becker has 36 years of experience in executive management, risk management, hedging and derivatives, supply chain management, mergers and acquisitions, and operations in a variety of commodity processing and manufacturing companies, as well as significant international experience in agricultural and energy markets. He held numerous executive positions at ConAgra Foods for eleven years, including vice president of International Trading and Marketing for ConAgra Trade Group and President of ConAgra Canada. He also worked on the audit and compensation committees. Mr. Becker has been the President, CEO, and Director of Green Plains Inc. since 2009, as well as the Chief Executive Officer and Director of Green Plains Partners since its inception in 2015. Mr. Becker holds a master’s degree in finance from Indiana University’s Kelley School of Business and a bachelor’s degree in business administration with a finance specialization from the University of Kansas.

Mr. Rozov has over 20 years of expertise in capital markets, corporate finance, investment banking, and investment management. He also serves on the boards of banking, insurance, chemicals, and pharmaceutical companies. Mr. Rozov is also the founder and Managing Partner of Terrace Edge Ventures LLC and was previously a Partner at GoldenTree Asset Management LLC, a renowned worldwide credit asset management organization. In addition, he was a Partner and Managing Director at Moelis & Company, where he led the Financial Institution Advisory Group, and a co-founder of College Ave Student Loans LLC. Mr. Rozov holds an M.Sc. in data science from Columbia University and a B.S. with highest honors in physics and materials engineering from Rutgers University.

Mr. Sullivan is the current CEO of Core Scientific, Inc., and has over a decade of expertise in financial services, specializing in investment banking in the digital assets and infrastructure field. His expertise includes strategy creation, corporate finance, and M&A. Adam worked as a Managing Director and Head of Digital Assets and Infrastructure at XMS Capital Partners before becoming President of Core in 2023. Mr. Sullivan established himself as a key facilitator for M&A and capital raises in the cryptocurrency mining industry while at XMS. He formerly worked with Indian Wells Capital Management and M&T Bank. Mr. Sullivan earned a Bachelor of Arts in Financial Economics from the University of Rochester.

Eric Weiss. Mr. Weiss has been on the Board of Directors since January 23, 2024. Since October 2017, Mr. Weiss has served as the founder and Chief Investment Officer of Blockchain Investment Group LP, a hedge fund of funds that invests only in blockchain assets. Mr. Weiss started his career as a US government bond dealer at Morgan Stanley Dean Witter. After receiving his MBA from Columbia Business School, Mr. Weiss joined GE Capital’s Private Equity and Venture Capital Division as a Director in the internet business field. While in this position, a client firm, Internet Capital Group (ICG), approached Mr. Weiss about joining as Director of Investments in Business-to-Business Internet Companies. Mr. Weiss also served as ICG’s board representative for several portfolio businesses. Eric left ICG to become a founding Principal at Stripes Group, where he identified and led investments in internet direct marketing.

Opinion: I don’t get it and don’t want to invest the time to GET IT.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,