Something significant is happening when staid Dell Technologies is up 31% on its latest quarterly earnings. A massive uptick in capex spending is underway, directly attributable to the stampede to embrace AI. After a year or more of belt-tightening in tech spending, that moment has arrived, almost all at once, when companies realize they have to invest in AI or be disrupted or obsoleted by a Chatbot, robot, or some version of machine learning. This is truly an “internet game-changing moment,” and the spending free-for-all has just begun.

The architect behind this 20-year evolution is NVidia, a handful of semiconductor enablement companies and small groups of impassioned scientists breaking ground on artificial intelligence due to the unprecedented leap forward in computing power, trampling Moore’s law. According to Mustafa Suleyman in The Coming Wave, published in 2023, “..over the last decade, the amount of computation used to train the largest models has increased exponentially. Google’ PaLM uses so much that were you to have a drop of water for every floating operation(FLOP) it used during training, it would fill the Pacific.”

These knowable outcomes will be mind-blowing efficiencies in accomplishing routine tasks like answering emails, customer support, knowledge worker productivity, factory automation, etc. The list could go on for pages only limited by my imagination and your attention. The next layer is more complex, solving engineering problems, questions about the building blocks of life, diagnosis of rare, untreatable diseases, and so on, until we get to the questions we don’t even know yet.

From an investor’s perspective, it’s easy to put all your chips down on what’s moving and shaking in the market. That is usually a rookie mistake. Paying attention to what insiders are buying is a way to keep your irrational behavior in check. FOMO left many people in ruins after the technology Winter after the Dot-com bubble burst.

You can be an insider, too– by clicking here. but please carefully read the caveats before investing. I would appreciated hearing your comments.

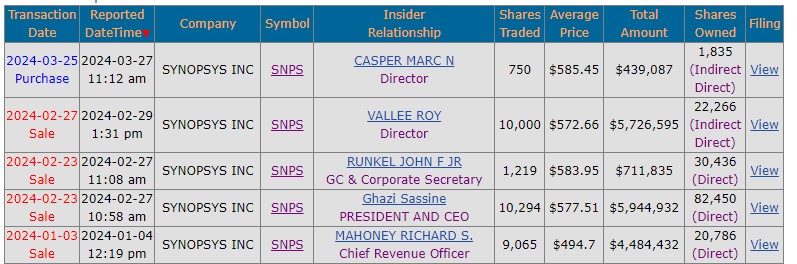

Name: Marc N Casper

Position: Director

Transaction Date: 2024-03-25 Shares Bought: 750 Average Price Paid: $585.45 Cost: $439,087

Company: Synopsys Inc (SNPS)

Synopsys, Inc. provides technologies and services that are used along the silicon-to-software spectrum to bring Smart Everything to life. From engineers developing advanced semiconductors to product teams developing advanced electronic systems to software developers seeking to ensure the security and quality of their code. They are a global leader in providing electrical design automation (EDA) software, which engineers use to build and test integrated circuits, commonly known as chips or silicon. The company provides software and hardware for validating electronic systems that combine chips and the software that runs on them, as well as a cloud-based digital design flow to increase chip-design development productivity. They also offer technical services and support to assist their customers in developing sophisticated chips and electrical systems. The company was founded in 1986 and has its headquarters in Sunnyvale, California.

Marc N. Casper has been a member of the Board of Directors since May 2022. Mr. Casper has been the President and CEO of Thermo Fisher Scientific Inc., a renowned life sciences firm, since October 2009, and the Chairman of the Board of Directors since February 2020. Mr. Casper formerly held various executive positions at Thermo Fisher Scientific Inc. from 2006 to 2009, including Chief Operating Officer. Before the merger that formed Thermo Fisher Scientific Inc. in 2006, Mr. Casper was in charge of all of Thermo Electron Corporation’s operating divisions and held several top roles inside the corporation. Before joining Thermo Electron Corporation in 2001, Mr. Casper was President, CEO, and Director of Kendro Laboratory Products. Mr. Casper now serves on the boards of various non-profit organizations, having previously served on the board of U.S. Bancorp from 2016 to 2021.

Opinion: Unusual to see insider buying in this group, but it’s something we note even if the simultaneous selling dwarf’s the buying because Synopsis is one of the key foundational parties that makes today’s advanced GPU’s possible. It’s critical to the coming wave of AI that changes everything.

Name: Martha A M Morfitt

Position: Director

Transaction Date: 2024-03-26 Shares Bought: 3,700 Average Price Paid: $389.05 Cost: $1,439,501

Company: Lululemon Athletica Inc. (LULU)

Lululemon Athletica Inc. and its subsidiaries create, distribute, and sell athletic clothes, footwear, and accessories under the Lululemon brand for women and men. The company sells pants, shorts, tops, and jackets for healthy lifestyles including yoga, running, training, and other hobbies. The company sells its products through a network of company-owned stores, outlets, an interactive workout platform, yoga and fitness studios, university campus retailers, and other partners, license and supply arrangements, temporary locations, mobile apps, and the lululemon.com e-commerce website. It operates in the United States, Canada, Mainland China, Australia, South Korea, Hong Kong, Japan, New Zealand, Taiwan, Singapore, Malaysia, Macau, Thailand, the Asia Pacific, the United Kingdom, Germany, France, Ireland, Spain, the Netherlands, Sweden, Norway, Switzerland, Europe, the Middle East, and Africa. Lululemon Athletica Inc. was formed in 1998 and is headquartered in Vancouver, Canada.

Martha A. M. Morfitt is a corporate executive who has led five separate firms. Ms. Morfitt is currently the Chairman of Lululemon Athletica, Inc., the Chairman of Grey Oaks Country Club, Inc., and the President & CEO of River Rock Partners, Inc. Ms. Morfitt also serves on the boards of Graco Inc. and Olaplex Holdings Inc. Martha A. M. Morfitt has previously served as President, CEO, and Director of CNS, Inc., CEO of Airborne, Inc., Vice President of The Pillsbury Co. LLC, and Secretary and Trustee of American Public Media Group. Martha A. M. Morfitt holds an undergraduate degree from the University of Western Ontario and an MBA from York University.

Opinion: Investors rarely get an opportunity to buy this crème’ de la crop retailer on a pullback. Here it is!

Name: Sridhar Ramaswamy

Position: Chief Executive Officer

Transaction Date: 2024-03-25 Shares Bought: 31,542 Average Price Paid: $158.52 Cost: $5,000,038

Company: Snowflake Inc. (SNOW)

Snowflake Inc. was established in 2012 and has its head office in Bozeman, Montana. Snowflake helps organizations learn, grow, and collaborate with their data-driven peers. Snowflake tackles the long-standing issue of data silos and governance. The firm platform, which leverages the public cloud’s elasticity and performance, enables enterprises to unify and query data for a variety of use cases. The company envisions a data-connected society in which businesses can simply discover, exchange, and realize the value of data. To achieve this goal, they provide the Data Cloud, a network that allows Snowflake clients, partners, developers, data producers, and data consumers to break down data silos and extract value from rapidly rising data quantities in a secure, controlled, and compliant manner. The firm platform is the cutting-edge technology that powers the Data Cloud, allowing clients to consolidate data into a single source of truth, provide useful business insights, build data applications, and share data and data products.

Mr. Ramaswamy, has held different positions at the company, including Senior Vice President, Artificial Intelligence, since May 2023. From October 2018 to February 2024, Mr. Ramaswamy was a Venture Partner at Greylock Partners. Mr. Ramaswamy served as Neeva Inc.’s CEO from January 2019 to May 2023. From August 2017 to December 2019, Mr. Ramaswamy sat on the board of directors of Palo Alto Networks Inc., a global cybersecurity company. From March 2013 to October 2018, Mr. Ramaswamy was Google’s Senior Vice President of Ads and Commerce. Mr. Ramaswamy earned a B.S. in Computer Science from the Indian Institute of Technology Madras, as well as an M.S. and Ph.D. in Computer Science from Brown University.

Opinion: Investors fell all over themselves buying this novel database company when it came out of stealth mode and finally went public. Now they are falling over themselves getting out of the name. Ramaswamy is definitely the horse to ride in this now insanely competitive business. https://copilot.microsoft.com/sl/cP9GixJ7cRw

Name: Brent Windom

Position: Director

Transaction Date: 2024-03-27 Shares Bought: 4,700 Average Price Paid: $85.34 Cost: $401,098

Company: Advance Auto Parts Inc (AAP)

Advance Auto Parts Inc. is a major automotive aftermarket parts supplier in North America, serving professional installers, customers, and independently held businesses. The shops and locations offer a diverse selection of brand-name, original equipment manufacturers, and pre-owned automobile replacement parts, accessories, batteries, and maintenance items for American and foreign cars, vans, sport utility vehicles, and light and heavy-duty trucks. The Advance Stores Company, Inc. was founded in 1929 and operated as a general merchandise shop until the 1980s. During the 1980s, the company concentrated on selling car parts and accessories to do-it-yourself customers. The company established its professional delivery program in 1996 and has significantly increased sales to professional clients since 2000.

Mr. Windom became a member of the Board in March 2024. Mr. Windom has been the president of Windom Consulting LLC, which offered strategic consulting services to Uni-Select, Inc. Before founding Windom Consulting, Mr. Windom served as President and CEO of Uni-Select until his retirement in 2021. Mr. Windom was President and Chief Operating Officer of Canadian Automotive Group from 2017 to 2019, during which time he oversaw the company’s strategic assessment and turnaround. Before 2017, Mr. Windom was the CEO of Icahn Automotive Group LLC and the COO of Uni-Select USA.

Opinion: Why are insiders buying Advanced Auto Parts when the stock has been dead money for decade long holders? It looks like it recently bottomed and probably represents a ‘bargain’ but I have no long term faith in the name. Let’s call it a value trap.

Name: Jeffrey Gould

Position: President And CEO

Transaction Date: 2024-03-18 Shares Bought: 22,214 Average Price Paid: $16.24 Cost: $360,842

Company: BRT Apartments Corp. (BRT)

BRT is an internally managed real estate investment trust, or REIT, that owns, operates, and, to a lesser extent, invests in joint ventures that own and run multi-family properties. As of December 31, 2023, The company (i) wholly owns 21 multi-family properties totaling 5,420 units; (ii) have ownership interests in seven multi-family properties totaling 2,287 units through unconsolidated entities; and (iii) owns other assets through consolidated and unconsolidated subsidiaries. The 28 multifamily properties are spread throughout 11 states, with the majority concentrated in the Southeast and Texas. The company’s multi-family properties are often garden apartments, mid-rises, or townhouses that offer residents amenities such as a clubhouse, swimming pool, laundry facilities, and cable television access. Residential leases are normally for one year and may include a security deposit of one month’s rent.

Jeffrey is the President, CEO, and a member of the Board of Directors of BRT Apartments Corp. BRT provides joint venture shares on multifamily buildings across the country and purchases them directly. Jeff also serves as a Vice President of Georgetown Partners, Inc. (the Managing General Partner of Gould Investors L.P.), an equity-oriented real estate company; Senior Vice President and Member of the Board of Directors of One Liberty Properties, Inc., a single tenant triple net leased public company; and Majestic Property Management Corp. Jeff is a member of the Chief Executive Organization (CEO) and the World Presidents Organization’s New York Big Apple Chapter. Jeff earned a BA from the University of Michigan. Jeff and his wife Suzanne have six children and live in Old Westbury, New York.

Opinion: Gould is a consistent buyer of BRT. Frankly interest rates need to go down to make this name work.

Name: Jerral W. Jones / Blue Star Exploration Corp / Arkoma Drilling L.P. / Williston Drilling L.P.

Position: 10% Owner

Transaction Date: 2024-03-25 Shares Bought: 12,500,000 Average Price Paid: $8.04 Cost: $100,450,000

Company: Comstock Resources Inc (CRK)

Comstock Resources, Inc. was established in 1919 and is based in Frisco, Texas. The company is a top independent natural gas producer, focusing largely on the Haynesville shale, a prime natural gas region with superior economics due to its proximity to Gulf Coast markets. The company is focused on producing value by developing its considerable inventory of highly economic and low-risk drilling opportunities in the Haynesville and Bossier shales, as well as by conducting exploration efforts in their Western Haynesville play. The common stock is listed and traded on the New York Stock Exchange under the ticker symbol “CRK”.

Jerry Jones, a co-captain on the University of Arkansas’ 1964 national championship team, has a lengthy history with football. His most valued asset is the Dallas Cowboys. Jones established himself as an oil wildcatter, investing his first million in oil in the 1970s. He continues to invest in drilling possibilities, as well as retail and residential real estate developments in Dallas. Jones acquired control of Comstock Resources, a publicly traded Texas oil and gas business, in a 2018 transaction. Jones is an enthusiastic art collector who owns Norman Rockwell’s “Coin Toss” as well as works by Picasso, Renoir, and Matisse, among others.

Blue Star Exploration Ghana Limited is an independent Ghanaian oil and gas exploration and production firm. Blue Star intends to be an African independent oil and gas exploration firm that focuses on frontier exploration acreage and brownfield assets. The Blue Star strategy is built on three pillars, including the use of talented workers and local partnerships to produce value in the oil and gas exploration and production sectors. Blue Star and its partners, Heritage Oil Limited and GNPC Exploration and Production Company Limited, were given two high-impact exploration licenses offshore Ghana in the prolific Tano Basin and the underexplored Keta Basin in July 214. Blue Star led the subsurface study and commercial talks with the Ghanaian government to discover and obtain the Petroleum Agreements. The company’s strategy calls for it to actively add assets to its portfolio, particularly in the West African region, while also exploring other parts of the oil and gas value chain.

Arkoma Drilling, L.P., provides oil and gas drilling services. Arkoma Drilling LP is a private exploration and production business with its headquarters in Frisco, Texas.

Williston Drilling is owned by Jerry Jones and his family, a Dallas industrialist and the proprietors of the Dallas Cowboys Football Club Ltd.

Opinion: The good news is that CRK rose 18% last week on news that a group affiliated with Jerry Jones of the Dallas Cowboys added ~$100 million worth of stock to his controlling interest. I’m very optimistic about Exxon and Devon, but Comstock has always been a speculative bet about the growth of the natural gas export market.

The Biden administration compounded the supply situation by slow-walking LNG export projects, stranding much sought-after American natural gas. They emptied the Strategic Petroleum Reserve to fight inflation, reducing it to current levels not seen since 1985. Cheap gasoline at the pump never lost any votes but weighed on all the fossil fuel stocks in the 1st quarter.

Name: Ankur Dhingra

Position: Chief Financial Officer

Transaction Date: 2024-03-26 Shares Bought: 100,000 Average Price Paid: $3.75 Cost: $375,000

Company: Summit Therapeutics Inc. (SMMT)

Name: Mahkam Zanganeh

Position: Chief Executive Officer

Transaction Date: 2024-03-26 Shares Bought: 110,321 Average Price Paid: $3.73 Cost: $411,094

Company: Summit Therapeutics Inc. (SMMT)

Summit Therapeutics Inc. is a biopharmaceutical company dedicated to the discovery, development, and commercialization of medicinal therapies that are patient-, physician-, caregiver-, and societal-friendly, to improve quality of life, increase potential life span, and address significant unmet medical needs. The Company’s pipeline of product candidates is intended to become patient-friendly, new-era standard-of-care medications in the field of oncology. Ivonescimab, the Company’s current lead development candidate, is a unique, potentially first-in-class bispecific antibody that combines the benefits of immunotherapy through PD-1 blockage with the anti-angiogenesis actions of an anti-VEGF chemical into a single molecule. On December 5, 2022, the Company signed a Collaboration and License Agreement with Akeso, Inc. and its affiliates, under which the Company has in-licensed ivonescimab. The company was founded in 2003 and is headquartered in Miami, Florida.

Ankur Dhingra is the Chief Financial Officer, overseeing finance, human resources, and information technology responsibilities. Mr. Dhingra has more than 25 years of finance and accounting expertise in the Diagnostics, Life Sciences, and Electronics Tools industries. Mr. Dhingra most recently served as CFO at CareDx, Inc., a company focusing on the transplant patient journey, where he oversaw Finance, IT, and Market Access functions. Mr. Dhingra formerly worked with Agilent Technologies, Inc. for 18 years in different finance and business management positions. Mr. Dhingra has held successive financial leadership positions, including numerous business unit CFO roles in Agilent’s Life Sciences and Applied Markets divisions. Mr. Dhingra is a chartered accountant with the Institute of Chartered Accountants of India. Beyond Summit, Mr. Dhingra serves on the Advisory Board of InstaMortgage, Inc.

Mahkam Zanganeh, the founder of Maky Zanganeh & Associates, Inc., is President, Co-Chief Executive Officer, and Director at Summit Therapeutics, Inc., President, Co-Chief Executive Officer, and Director at Summit Therapeutics Ltd., and CEO of Maky Zanganeh & Associates, Inc. Dr. Zanganeh also serves on the boards of Pulse Biosciences, Inc., and Image-Guided Hybrid Surgery Institute. She formerly worked as the Chief Operating Officer for Pharmacyclics, Inc., Vice President-Business Development at Robert W. Duggan & Associates, Chief Operating Officer for Pharmacyclics LLC, and Vice President-Worldwide Training & Education at Computer Motion, Inc. She earned a doctorate from Louis Pasteur University and an MBA from Schiller International University (France).

Opinion: Tread carefully around insiders buying biotech. More often than not its on a secondary or an IPO to shore up confidence and keep their dream alive. In this case, positive reviews at a European Lung Cancer, showed promise in a competitive molecule they are attempting to bring to market to compete with Merck’s blockbuster Keytruda and other lung cancer remedies.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,